Wisconsin Residents Struggle to Afford High Healthcare Costs; Worry about Affording Healthcare in the Future; Support Government Action across Party Lines

Key Findings

A survey of more than 1,100 Wisconsin adults, conducted from June 22 to July 6, 2022, found that:

• Nearly 3 in 5 (59%) experienced at least one healthcare affordability burden in the past year;

• 4 in 5 (81%) worry about affording healthcare in the future;

• Lower-income respondents and respondents with disabilities are more likely to go without care

and incur debt due to healthcare costs; and

• Across party lines, respondents express strong support for government-led solutions.

A Range of Healthcare Affordability Burdens

Like many Americans, Wisconsin adults experience hardship due to high healthcare costs. All told,

well over half (59%) of respondents experienced one or more of the following healthcare affordability

burdens in the prior 12 months:

1) Being Uninsured Due to High Premium Costs

Nearly one-half (45%) of uninsured respondents cited “too expensive” as the major reason for not

having coverage, far exceeding other reasons like “don’t need it” and “don’t know how to get it.”

2) Delaying or Forgoing Healthcare Due to Cost

More than half (52%) of all respondents reported delaying or going without healthcare during the

prior 12 months due to cost:

- 33%—Skipped needed dental care

- 31%—Delayed going to the doctor or having a procedure done

- 25%—Cut pills in half, skipped doses of medicine or did not fill a prescription1

- 25%—Avoided going to the doctor or having a procedure done altogether

- 25%—Skipped a recommended medical test or treatment

- 21%—Had problems getting mental healthcare or addiction treatment

- 14%—Skipped or delayed getting a medical assistive device

Moreover, cost and the ability to get an appointment were the most frequently cited reasons for not

getting needed medical care (reported by 21% and 17% of respondents, respectively), exceeding a host

of other barriers like a lack of transportation and or childcare. Notably, 12% of respondents cited the

fact that their service was not covered as a reason for not getting needed medical care.

3) Struggling to Pay Medical Bills

Other times, respondents got the care they needed but struggled to pay the resulting bill. Nearly two

in five (38%) experienced one or more of these struggles to pay their medical bills:

- 16%—Used up all or most of their savings

- 15%—Were contacted by a collection agency

- 11%—Were unable to pay for basic necessities like food, heat or housing

- 10%—Borrowed money, got a loan or another mortgage on their home

- 9%—Racked up large amounts of credit card debt

- 9%—Were placed on a long-term payment plan

Of the various types of medical bills, the ones most frequently associated with an affordability barrier

were doctor bills, dental bills and prescription drugs. The high prevalence of affordability burdens for

these services likely reflects the frequency with which Wisconsin respondents seek these services.

Trouble paying for dental bills likely reflects lower rates of coverage for these services.

High Levels of Worry About Affording Healthcare in the Future

Wisconsin respondents also exhibit high levels of worry about affording healthcare in the future. Four

in five (81%) reported being “worried” or “very worried” about affording some aspect of healthcare in

the future, including:

- 67%—Cost of nursing home or home care services

- 64%—Medical costs when elderly

- 62%—Health insurance will become unaffordable

- 61%—Medical costs in the event of a serious illness or accident

- 53%—Prescription drugs will become unaffordable

- 51%—Cost of dental care

- 35%—Cost of treatment for coronavirus/COVID-19

While two of the most common worries—affording the cost of nursing home or home care services

and medical costs when elderly—are applicable predominantly to an older population, they were most

frequently reported by respondents ages 25-54. This suggests that Wisconsin respondents may be

worried about affording the cost of care for both aging parents and themselves.

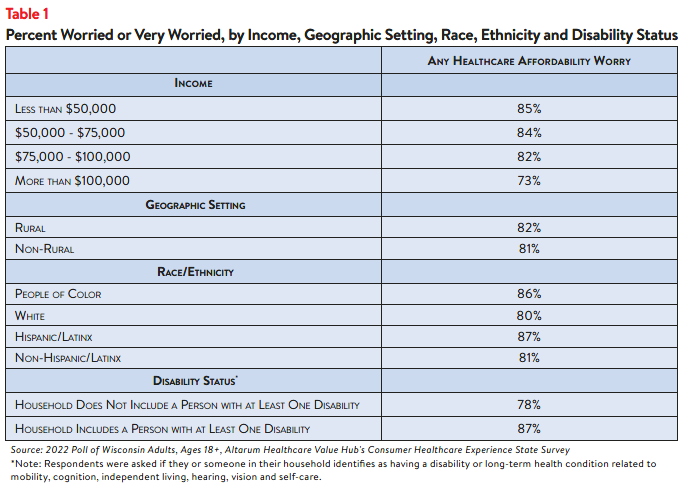

Worry about affording healthcare, generally, was highest among respondents living in low-income

households, respondents of color and those living in households with a person with a disability (see

Table 1). More than 4 in 5 (85%) of respondents with household incomes of less than $50,000 per

year2 reported worrying about affording some aspect of coverage or care in the past year. Still, the

vast majority of Wisconsin respondents of all incomes, races, ethnicities and levels of ability statewide

are somewhat or very concerned.

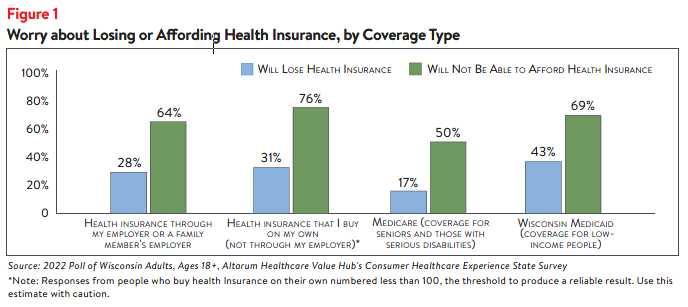

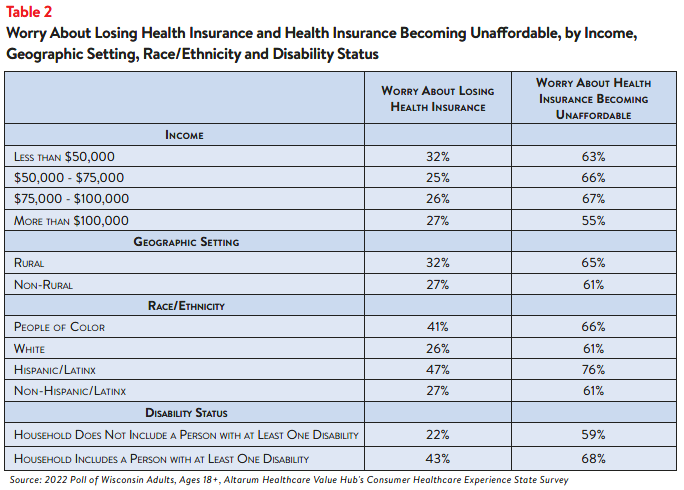

Concern that health insurance will become unaffordable is also more prevalent among certain groups

of Wisconsin adults. By insurance type, respondents with coverage they purchase on their own most

frequently reported worrying about affording coverage, followed by those with Wisconsin Medicaid

(see Figure 1). However, those with Wisconsin Medicaid most frequently reported worrying about

losing their health insurance.

Those with household incomes between $75,000 and $100,000 reported the highest rates of worry

about affording health insurance coverage, followed closely by those earning between $50,000 and

$75,000 (see Table 2). Lower-income respondents reported the highest rates of worry about losing

their health insurance, although respondents in other income brackets were not far behind in rates

of worry. Rural respondents and those living in households with a person with a disability were more

likely to be concerned about losing health insurance specifically than their non-rural and non-disabled

counterparts (see Table 2).

Concerns about affording coverage exceeded fears about losing coverage across all income groups,

disability statuses, races/ethnicities, geographic settings and coverage types.

Differences in Healthcare Affordability Burdens

The survey also revealed differences in how Wisconsin respondents experience healthcare affordability

burdens by income, age, race/ethnicity, geographic setting and disability status.

Income and Age

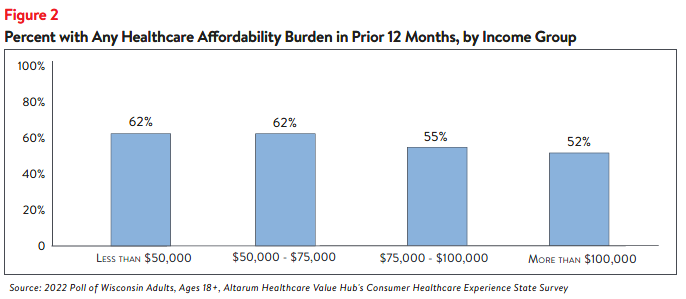

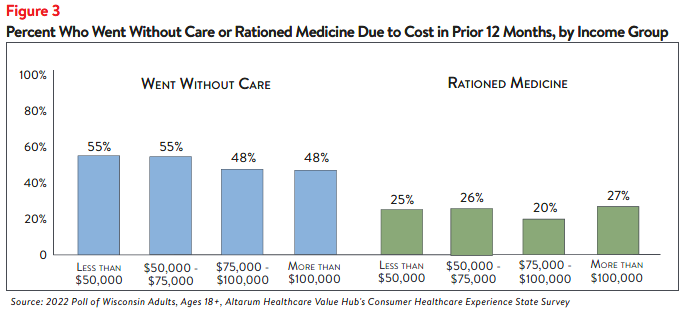

Unsurprisingly, respondents at the lower and middle end of the income spectrum most frequently

reported experiencing one or more healthcare affordability burdens, with 3 out of 5 respondents

(62%) earning less than $75,000 reporting struggling to afford some aspect of coverage or care in

the past 12 months (see Figure 2). The high levels of healthcare affordability burdens reported by

these groups may be due, in part, to high reported rates of going without care and rationing their

medication due to cost among these income groups (see Figure 3).

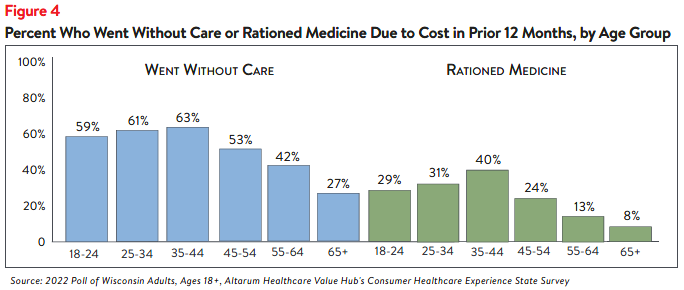

Further analysis found that Wisconsin respondents ages 18-44 more frequently reported going

without care due to cost than respondents ages 45 and up (see Figure 4). Respondents ages 35-44

most frequently reported rationing medication due to cost, compared to other age groups.

Race and Ethnicity

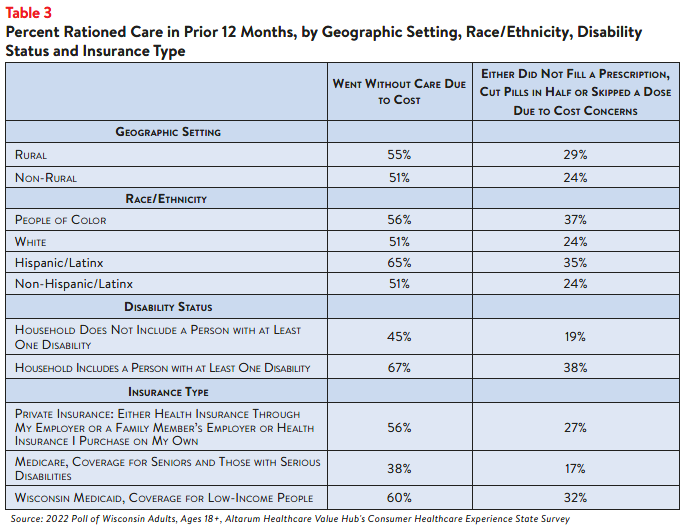

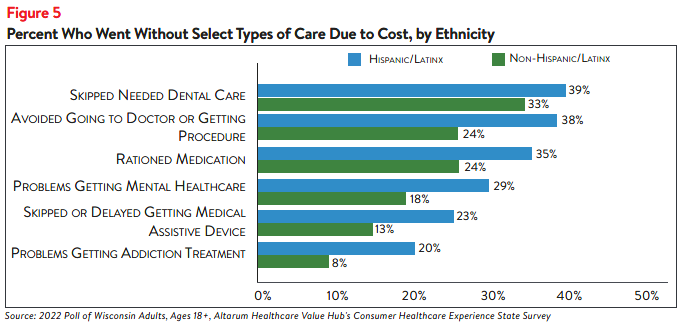

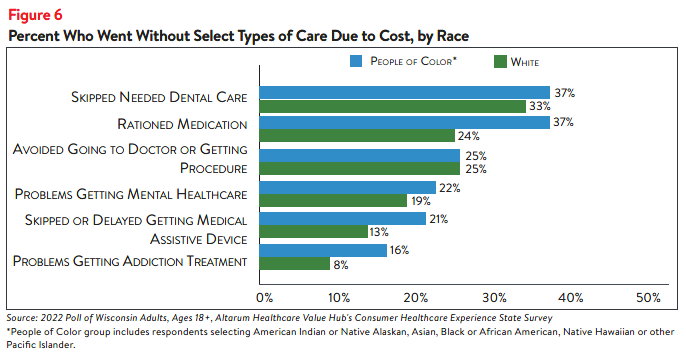

Respondents of color reported higher rates of going without care and rationing medication due to

cost when compared to white respondents—this trend is also visible between Hispanic/Latinx and non-

Hispanic/Latinx respondents (see Table 3). Further analysis showed that respondents of color reported

slightly higher rates of encountering problems when getting mental health care and addiction

treatment (see Figures 5 and 6). Similarly, Hispanic/Latinx respondents more frequently reported

going without all types of care than non-Hispanic/Latinx respondents.

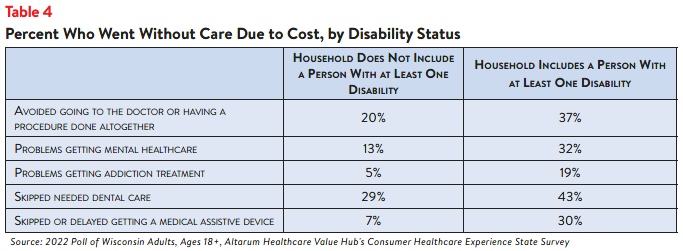

Disability Status

Of all the demographic groups measured, respondents living in households with a person with a disability

reported the highest rates of going without care and rationing medication due to cost in the past 12

months. Sixty-seven percent of respondents in this group reported going without some form of care

and over one-third (38%) reported rationing medication, compared to 45% and 19% of respondents

living in households without a person with a disability, respectively (see Table 3). Respondents living in

households with a person with a disability also more frequently reported delaying or skipping getting

mental healthcare, addiction treatment and dental care, among other healthcare services, than those in

households without a person with a disability due to cost concerns (see Table 4).

Those with disabilities also face healthcare affordability burdens unique to their disabilities—30% of

respondents reporting a disability in their household reported delaying getting a medical assistive

device such as a wheelchair, cane/walker, hearing aid or prosthetic limb due to cost. Just 7% of

respondents without a person with a disability (who may have needed such tools temporarily or may

not identify as having a disability) reported this experience.

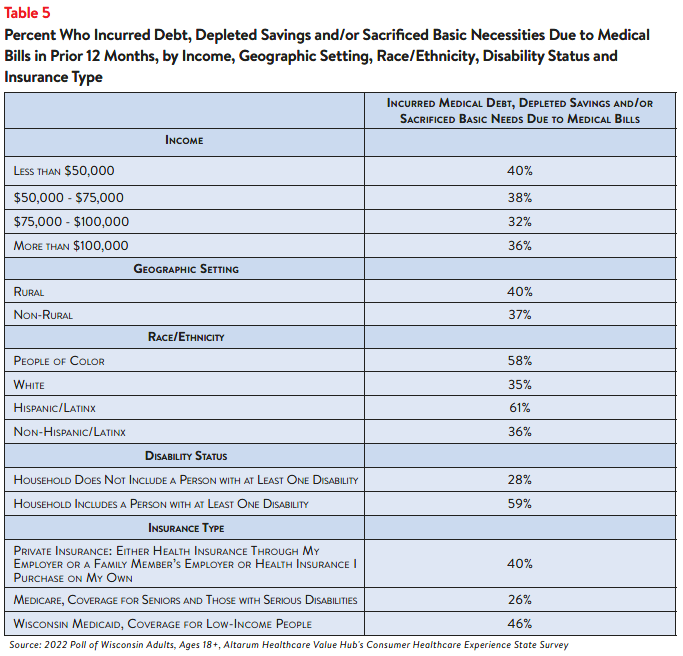

Likelihood of Encountering Medical Debt

The survey also showed differences in the prevalence of financial burdens due to medical bills,

including going into medical debt, depleting savings and being unable to pay for basic necessities (like

food, heat and housing) by income, race, ethnicity, disability status and geographic setting. Fifty-eight

percent of respondents of color reported going into debt, depleting savings or going without other

needs due to medical bills, compared to 35% of white respondents (see Table 5). This trend in financial

burden remains true for respondents who identified as Hispanic/Latinx (61%) compared to non-

Hispanic/Latinx respondents (36%).

Respondents living in households with a person with a disability had a similar disparity, with more than

half (59%) reporting going into debt or going without other needs due to medical bills, compared

to 28% of respondents living in households without a disabled member. Geographically, Wisconsin

respondents living in rural counties reported higher rates of going into debt or going without other

needs due to medical bills (40%) than respondents from non-rural counties (37%). In addition,

respondents on Wisconsin Medicaid reported the highest rate of financial burdens due to medical bills

(46%) compared to all other insurance types. However, 40% of respondents with private insurance

coverage also reported incurring medical debt, depleting their savings or going without other needs

due to medical bills.

Dissatisfaction with the Health System and Support for Change

In light of Wisconsin respondent’s healthcare affordability burdens and concerns, it is not surprising

that they are dissatisfied with the health system:

- Just 34% agreed or strongly agreed that “we have a great healthcare system in the U.S.,”

- While 70% agreed or strongly agreed that “the system needs to change.”

To investigate further, the survey asked about both personal and governmental actions to address

health system problems.

Personal Actions

Wisconsin respondents see a role for themselves in addressing healthcare affordability. When asked

about specific actions they could take:

- 48% of respondents reported researching the cost of a drug beforehand, and

- 78% said they would be willing to switch from a brand name to an equivalent generic drug if given the chance.

When asked to select the top three personal actions they felt would be most effective in

addressing healthcare affordability (out of ten options), the most common responses were:

- 69%—Take better care of my personal health

- 38%—Research treatments myself, before going to the doctor

- 31%—Do more to compare doctors on cost and quality before getting services

However, 27% of respondents chose the response “There is not anything I can do personally to make

our health system better,” as one of their top three personal actions.

Government Actions

But far and away, Wisconsin respondents see government as the key stakeholder that needs to act

to address health system problems. Moreover, addressing healthcare problems is one of the top

priorities that respondents want their elected offcials to work on.

At the beginning of the survey, respondents were asked what issues the government should address in

the upcoming year. The top vote getters were:

- 50%—Healthcare

- 47%—Economy/Joblessness

- 34%—Taxes

When asked about the top three healthcare priorities the government should work on, the top vote

getters were:

- 49%—Address high healthcare costs, including prescription drugs

- 38%—Preserve consumer protections preventing people from being denied coverage or charged more for having a pre-existing medical condition

- 35%—Improve Medicare, coverage for seniors and those with serious disabilities

- 31%—Get health insurance to those who cannot afford coverage3

Of more than 20 options, Wisconsin respondents believe the reason for high healthcare costs is unfair

prices charged by powerful industry stakeholders:

- 74%—Drug companies charging too much money

- 70%—Hospitals charging too much money

- 64%—Insurance companies charging too much money

When it comes to tackling costs, respondents endorsed a number of strategies, including:

- 93%—Show what a fair price would be for specific procedures

- 92%—Require drug companies to provide advanced notice of prices increases and information to justify those increases

- 91%—Require insurers to provide up-front cost estimates to consumers

- 91%—Make it easy to switch insurers if a health plan drops your doctor

- 91%—Require hospitals and doctors to provide up-front cost estimates to consumers

- 91%—Authorize the Attorney General to take legal action to prevent price gouging or unfair prescription drug price hikes

- 91%—Cap out-of-pocket costs for life-saving medications, such as insulin

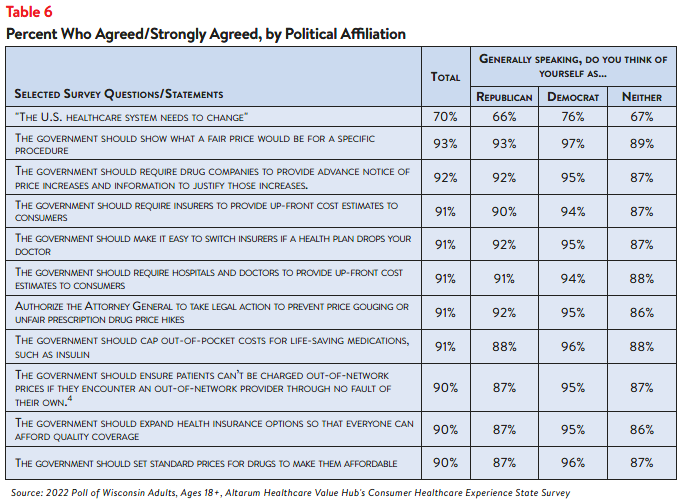

Support for Action Across Party Lines

There is also remarkable support for change regardless of respondents’ political affliation (see Table 6).

The high burden of healthcare affordability, along with high levels of support for change, suggest that

elected leaders and other stakeholders need to make addressing this consumer burden a top priority.

Moreover, the COVID crisis has led state residents to take a hard look at how well health and public

health systems are working for them, with strong support for a wide variety of actions. Annual surveys

can help assess whether or not progress is being made.

Notes

- Of the current 52% of Wisconsin respondents who encountered one or more cost-related barriers to

getting healthcare during the prior 12 months, 18% did not fill a prescription, while 17% cut pills in half or

skipped doses of medicine due to cost. - Median household income in Wisconsin was $63,293 (2016-2020). U.S. Census, Quick Facts. Retrieved

from: U.S. Census Bureau QuickFacts: Wisconsin - Two in 3 (66% of) respondents said that they would consider using their tax forms to sign up for health

insurance if they or their family needed it. This high level of interest persisted across racial, ethnic and

income groups, with the highest levels of interest among respondents of color (70%), Hispanic/Latinx

respondents (72%) and those earning between $75,000 and $100,000 (75%) - This policy strategy has been implemented at the federal level through the 2020 No Surprises Act,

but state governments may issue their own policies to bring state statute in line with the federal law.

Importantly, unexpected medical bills resulting from ground ambulance services are not addressed by

the No Surprises Act

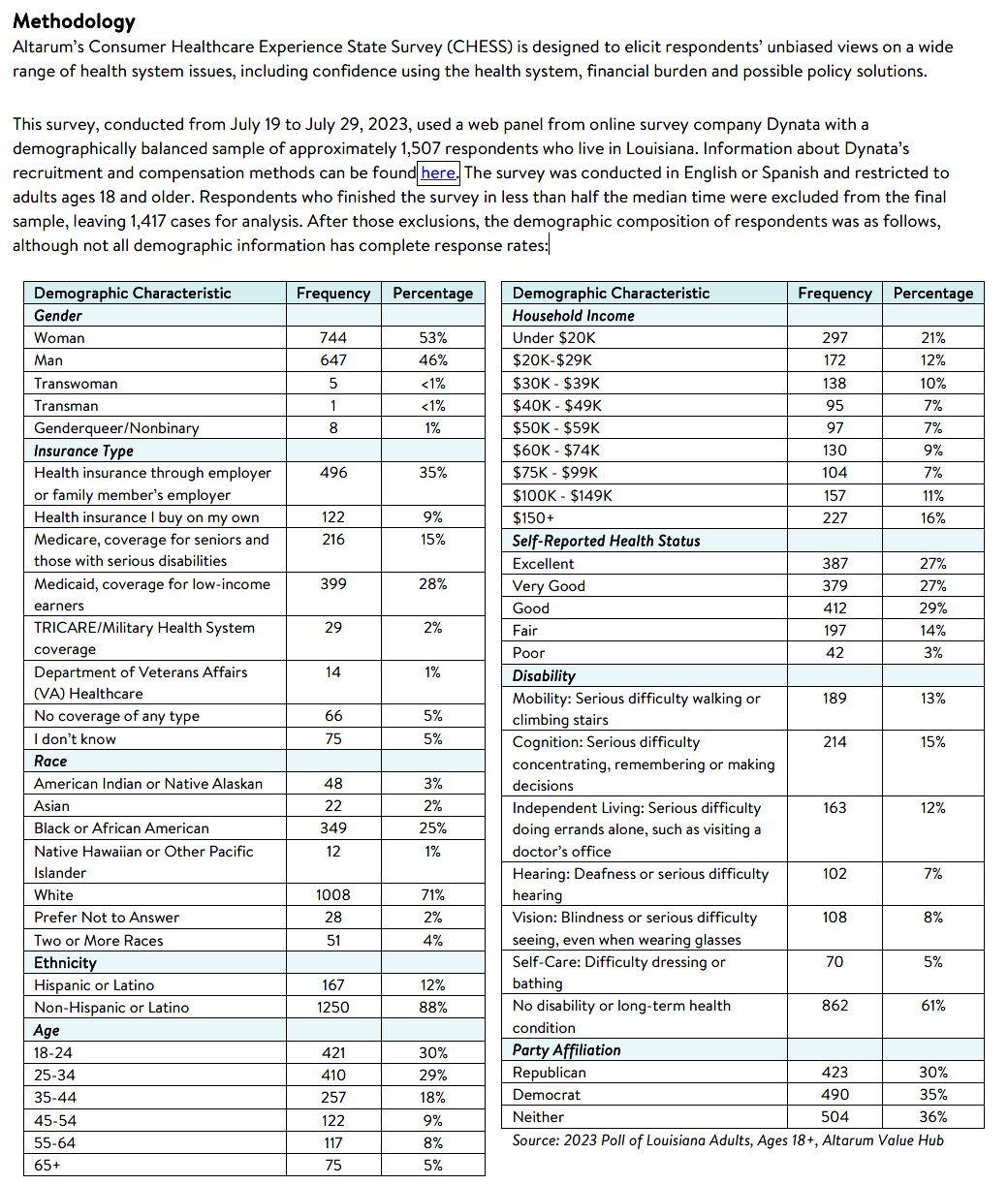

Methodology

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ unbiased views on a wide range of health system issues, including confidence using the health system, financial burden, and views on fixes that might be needed.

The survey used a web panel from Dynata with a demographically balanced sample of approximately 1,196 respondents who live in Wisconsin. The survey was conducted in English or Spanish and restricted to adults ages 18 and older. Respondents who finished the survey in less than half the median time were excluded from the final sample, leaving 1,113 cases for analysis. After those exclusions, the demographic composition of respondents was as follows, although not all demographic information has complete response rates: