Improving Value

Disrupting the Medical Debt Collection Highway

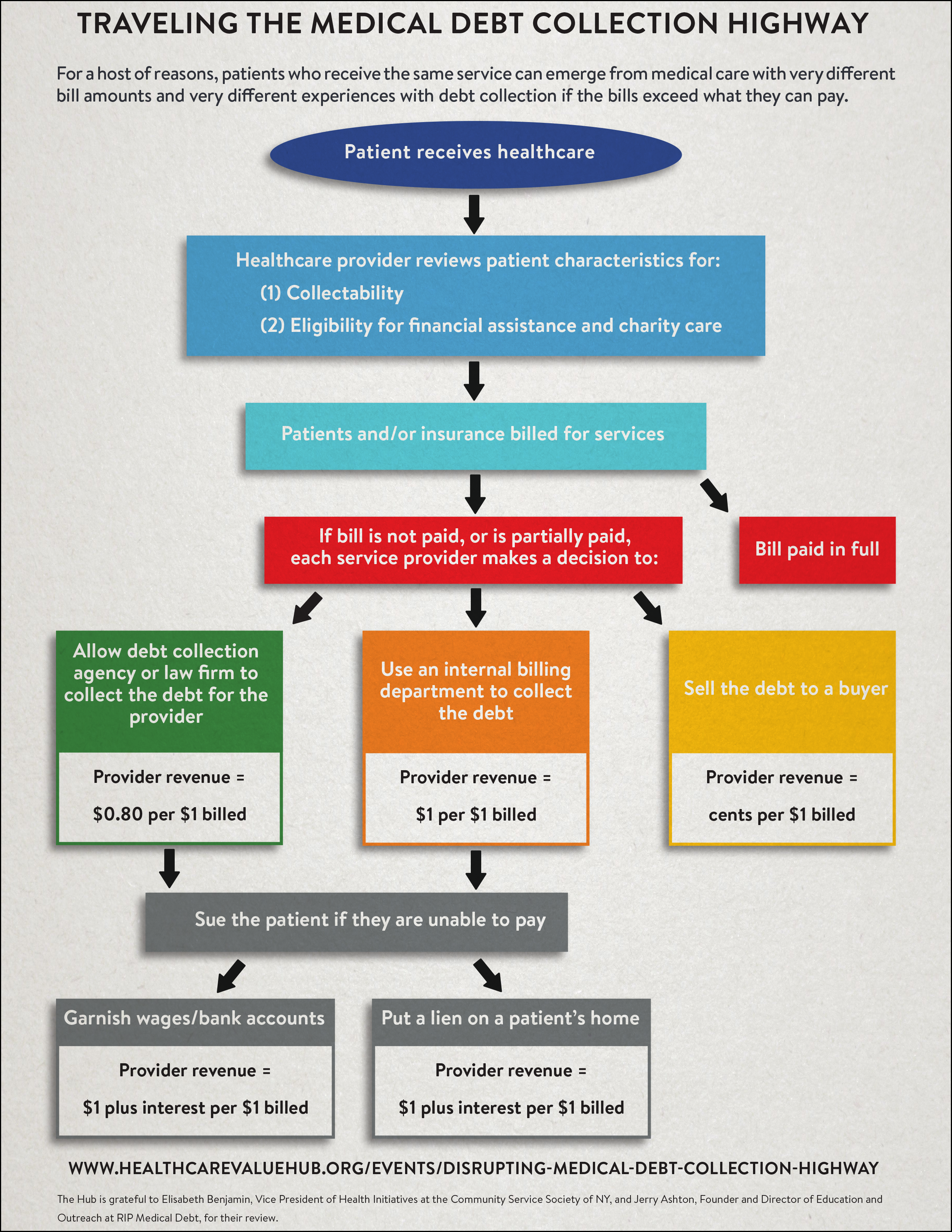

As the accompanying infographic shows, patients who receive the same service can emerge from medical care with very different bill amounts and different experiences of debt collection if the bills are more than they can pay. The table below shows how some states are disrupting this highway by inserting consumer protections at various "checkpoints."

| Strategy to Disrupt the Medical Debt Highway | What are states doing? | |

| Prevent medical debt from occuring in the first place. | ||

| Ensure residents are adequately covered - Being un- or under-insured can quickly send people into debt when they need medical care. | Massachusetts is one of few states to adopt Affordability Standards to guide health policymaking. The state also as one of the lower uninsured rates in the nation.1 | |

| Clamp down on surprise medical bills - Even patients with good coverage can receive an unmanageable bill if their provider is unexpectedly out-of-network. | Industry observers have identified nine states - California, Connecticut, Florida, Illinois, Maryland, New Hampshire, New Jersey, New York and Oregon - that have comprehensive protections against balance billing associated with surprise out-of-network bills.2 | |

| More progress is needed, however, to address the prevalence of surprise medical bills at the point when provider networks are being established. | ||

| Strengthen hospital financial assistance policies. | ||

| Strengthen community benefit requirements - While non-profit hospitals have a federal community benefit obligation that includes financial assistance, some states impose additional requirements. | California, Florida, Indiana, Maine, Maryland, Montana, Nevada, New Hampshire and Washington have unconditional community benefit requirements.3 Delaware, Georgia, Illinois, Massachusetts, Mississippi, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Texas, Utah, Virginia and West Virginia have conditional community benefit requirements.4 |

|

| Making information on financial assistance widely available - Financial assistance | Illinois' Fair Patient Billing Act requires hospitals to post notices about the availability of financial assistance in the registration or admission areas of the hospital.5 New York hospitals must notify patients about the financial assistance programs they offer upon a patient's admission into the hospital.6 |

|

| When medical debt is incurred, state laws can curb the most aggressive collection tactics. | ||

| Cap bill amounts | California prohibits providers and hospitals from charging low-income families without health insurance more than the public price for healthcare services.7 Illinois limits the amount of hospital bills that can be charged for uninsured patients. Hospitals can collect only a maximum of 25 percent of a family or individual's household income in a year.8 In Minnesota, both under-insured and un-insured patients whose incomes are less than $125,000 per year receive the same discounts on their medical bills that insurance companies have negotiated directly with the hospitals.9 |

|

| Cap interest rates | California hospitals cannot charge patients interest if they are on a payment plan for unpaid medical debt.10 Maryland hospitals are prohibited from charging interest on medical bills and debts that are incurred by self-pay patients before a court judgement is obtained.11 In Illinois, interest is usually limited to 5 percent per year before a court judgement and 9 percent per year if the doctor has been taken to court and the court placed a judgement against the patient.12 When a settlement is agreed to in New York, patients can only be charged a limited amount of interest on unpaid balances according to the law. Medical debt collectors and hospitals can't increase the interest rate they charge on medical debt when someone misses a scheduled payment.13 |

|

| Limit debt collections | California hospitals must provide un- and under-insured families with a 150-day period in which debt collection efforts will not occur.14 Maryland hospitals cannot sell outstanding medical debts to a debt collection agency.15 |

|

| Establish a statute of limitations | In Arkansas, no action shall be brought to recover charges for unpaid medical bills resulting from services performed by a doctor, hospital or other medical service provider after a 2-year period.16 If a hospital, doctor or medical provider in Texas failed to bill the health insurer or the patient in a timely manner, the medical provider cannot attempt to collect the debt from the patient who received the service.17 |

|

| Set guardrails for collection techniques (lien on house, garnish wages) | In California, debt collection agencies cannot garnish a patient's wages or income.18 In Minnesota, it is illegal for hospitals to withdraw funds directly from a patient's bank account without the prior approval from a court or legal judgement.19 In New York, medical debt collectors, hospitals and other healthcare providers cannot force the sale of a patient's home, or foreclose on it, in order to collect an unpaid bill or debt.20 If a patient in Kansas has been unable to work for two or more weeks because of their own personal illness or an illness in their family, the debtor's wages cannot be garnished until two months after recovery from the illness.21 If a patient in Louisiana has medical debt resulting from a catastrophic or terminal illness or injury, the full value of that person's home is exempt from foreclosure or seizure or sale.22 In North Carolina, public hospitals can't seek to garnish the wages of patients whose total household income is 200% of the Federal Poverly Level or less. For higher income patients, a hospital cannot seek to garnish wages unless it: (1) has made reasonable efforts to collect the unpaid medical bills and debts from third party payers (such as a health insurer) and (2) has waited at least 120 days after sending the patient the bill.23 In Nevada and Ohio, homes can't be seized or sold for unpaid medical debt. Additionally, a home cannot be foreclosed upon while the debtor and/or their dependents still live in the home.24 |

|

| Specify who is excused | New Jersey residents who are eligible for free healthcare cannot be billed or subjected to medical debt collection practices. The state also prohibits hospitals from charging uninsured patients whose gross household income falls below 500 percent of the Federal Poverty Level.25 In New York, it is illegal to subject individuals who are eligible for Medicaid at the time of their service to debt collection practices.26 Illinois' Hospital Uninsured Patient Discount Act requires hospitals to offer charity care and discount charges to uninsured or low-income patients.27 Maryland mandates that hospitals provide free care for patients at or below 200% of the Federal Poverty Level, and reduced-cost care for patients with incomes between 200% and 500% of Federal Poverty Level.28 Maine requires hospitals to provide free care to state residents with incomes of 150% or less of the Federal Poverty Level.29 |

|

Notes

1. Altarum's Healthcare Value Hub, Research Brief No. 16: Making Healthcare Affordable: Finding a Common Approach to Measure Progress, Washington, D.C. (January 2017).

2. Hoadley, Jack, et al., State Efforts to Protect Consumers from Balance Billing, The Commonwealth Fund, New York, NY (January 18, 2019).

3. The Hilltop Institute UMBC, Community Benefit State Law Profiles Comparison: Conditional Community Benefit Requirement (Accessed March 10, 2020).

4. The Hilltop Institute UMBC, Community Benefit State Law Profiles Comparison: Unconditional Community Benefit Requirement (Accessed March 10, 2020).

5. Need Help Paying Bills, Get help with medical debt and bills in Illinois (Accessed March 10, 2020).

6. Need Help Paying Bills, Help with medical bills and debts in New York (Accessed March 10, 2020).

7. Need Help Paying Bills, Get help with medical debt and bills in California (Accessed March 10, 2020).

8. Need Help Paying Bills, Get help with medical debt and bills in Illinois (Accessed March 10, 2020).

9. Need Help Paying Bills, Minnesota laws and programs that help with medical debt collectors (Accessed March 10, 2020).

10. Need Help Paying Bills, Get help with medical debt and bills in California (Accessed March 10, 2020).

11. Need Help Paying Bills, Get help with medical debt and bills in California (Accessed March 10, 2020).

12. Need Help Paying Bills, Get help with medical debt and bills in Illinois (Accessed March 10, 2020).

13. Need Help Paying Bills, Help with medical bills and debts in New York (Accessed March 10, 2020).

14. Need Help Paying Bills, Get help with medical debt and bills in California (Accessed March 10, 2020).

15. Need Help Paying Bills, Stop medical debt collectors and Maryland (Accessed March 10, 2020).

16. Need Help Paying Bills, Get help with medical debt and bills in California (Accessed March 10, 2020).

17. Need Help Paying Bills, Find help with medical debt collectors and bills out for collection (Accessed March 10, 2020).

18. Need Help Paying Bills, Get help with medical debt and bills in California (Accessed March 10, 2020).

19. Need Help Paying Bills, Minnesota laws and programs that help with medical debt collectors (Accessed March 10, 2020).

20. Need Help Paying Bills, Get help with medical debt and bills in California (Accessed March 10, 2020).

21. Need Help Paying Bills, Find help with medical debt collectors and bills out for collection (Accessed March 10, 2020).

22. Need Help Paying Bills, Find help with medical debt collectors and bills out for collection (Accessed March 10, 2020).

23. Need Help Paying Bills, Find help with medical debt collectors and bills out for collection (Accessed March 10, 2020).

24. Need Help Paying Bills, Find help with medical debt collectors and bills out for collection (Accessed March 10, 2020).

25. Need Help Paying Bills, New Jersey assistance with medical bills and debt collectors (Accessed March 10, 2020).

26. Need Help Paying Bills, Help with medical bills and debts in New York (Accessed March 10, 2020).

27. Need Help Paying Bills, Get help with medical debt and bills in Illinois (Accessed March 10, 2020).

28. Stark, Andrea Bopp, "An Ounce of Prevention: A Review of Hospital Financial Assistance Policies in the States," National Consumer Law Center (January 2020).

29. Stark, Andrea Bopp, "An Ounce of Prevention: A Review of Hospital Financial Assistance Policies in the States," National Consumer Law Center (January 2020).