Consumer-Centric Healthcare: Managing Medical Bills and Costs

Healthcare is increasingly touted as consumer- or patient-centered. Research is beginning to show that revealing and catering to consumer preferences can lead to better outcomes, more efficient spending and higher patient satisfaction. But our health system too often fails to provide what consumers really want and need.

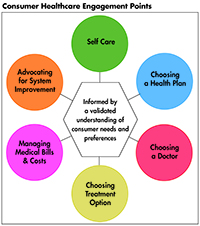

This Easy Explainer describes one of six consumer healthcare engagement points explored in the Hub’s Research Brief No. 18, Consumer-Centric Healthcare: Rhetoric vs. Reality, which outlines how these failings could be addressed and encourages a discussion of how to elevate, support and validate the consumer’s voice.

What are Consumers’ Preferences and Needs?

Lowering out-of-pocket costs and drug prices are a top priority for Americans. Two-thirds of consumers (67 percent) say lowering the amount people pay for healthcare should be a top priority for the President and Congress; and six in ten (61 percent) say lowering the cost of prescription drugs should be a top priority.1

High-deductible health plans are increasingly prevalent in both the employer and individual markets potentially exposing many consumers out-of-pocket costs they can’t afford.2 Since 2006, insurance deductibles have increased by 255 percent.3

These out-of-pocket costs are often misaligned with what people can pay. A majority of Americans (59%) don’t have enough available cash to pay a $1,000 emergency department bill or even a $500 car repair.4

Rising consumer payment responsibility has changed how consumers approach provider visits. In 2015, nine-out-of-10 consumers said it was important to know their payment responsibility prior to a provider visit.5 Consumers also want to know their payment options with their provider; and when given the option of various payment methods, more than 70 percent of consumer said they preferred to pay with an electronic payment method, including credit or debit cards.6 Consumers want the convenience of payment options common in other industries. For example, 75 percent of consumers choose to pay their household bills online, including bank bill-pay portals and mobile apps. Two-out-of-three consumers (65 percent) said they wanted to pay their health plan premiums online in 2015 and 57 percent said they wanted the option to schedule automatic deductions for recurring premium payments.7

Nearly half of consumers (47 percent) say they will switch providers if cost information and easy billing options were available elsewhere.8 This may be a case of stated preferences differing from revealed preferences-consumers tend to stick with their providers, especially when they are involved in treatment.

How the System Fails Consumers

Affording healthcare remains a top-of-mind worry for consumers.9

The trend toward shifting more costs to consumers through higher copays, coinsurance and high-deductibles burdens consumers and does not lower underlying health costs.

Poor benefit designs mean inadequate coverage for many. High-deductible health plans are causing consumers to cut back on needed healthcare services. They do not go to a doctor, skip getting recommended tests or treatments, don’t fill prescriptions, or cut back on preventive care.

Roughly 20 percent of people under age 65 with health insurance reported having problems paying their medical bills in 2015.10 By comparison, 53 percent of people without insurance said the same. Among those who reported having problems paying their bills despite having insurance, 63 percent said they used up all or most of their savings; 42 percent took on an extra job or worked extra hours; 14 percent moved or took in roommates; and 11 percent turned to charity.

How the System Can Better Meet Consumers’ Preferences and Needs

Insurance plans with enormous out-of-pocket costs will not solve the problem of rising health costs. Employers, the government and providers—as well as consumers—must work together to lower the underlying costs of healthcare.

Healthcare providers, hospitals, drug makers and medical-device makers should be encouraged to address high healthcare costs that are not sustainable for consumers. We need to build political support to cut unnecessary spending and reduce prices, not just push the cost onto consumers. And consumers need to support state and federal efforts to gather data in order to understand healthcare spending, see where consumers are experiencing high costs, and determine which markets lack competition or suffer from weak regulation.

Health plan designs should be simplified to make costs more predictable by using co-payments instead of coinsurance. And consumers should have access to timely, accurate, and actionable information to help them make decisions and find high-value care. One way to reduce the cost burden on consumers is for insurance companies to adopt more value-based design features that change benefit designs to have lower or no copayments for services such as office visits to manage chronic conditions; or to provide more services on a pre-deductible basis.

Payers and providers should take steps to help consumers avoid losing coverage. For example, payors could identify those who stopped payments early in the past and direct them to auto-pay options whenever possible or issue regular reminders about making payments. They could also reach out to any members they believe are likely to stop making future payments and make sure they understand both the penalties they may face and subsidies they may be eligible for.

Providers also have a role to play. For example, when patients appear to have financial difficulties, their provider could connect them with third-party organizations that may be able to offer payment assistance. Providers also could connect patients to in-house financial counselors or enrollment assistors to ensure that the patients understand subsidies and penalties.11

1. Kirzinger, Ashley, Bryan Wu, and Mollyann Brodie, Kaiser Health Tracking Poll: Health Care Priorities for 2017, Kaiser Family Foundation (Jan. 6, 2017).

2. Collins, Sara et al., The Problem of Underinsurance and How Rising Deductibles Will Make It Worse: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2014, The Commonwealth Fund (2014).

3. Claxton, Gary, et al., Employer Health Benefits 2016 Annual Survey, Kaiser Family Foundation, HRET (2016).

4. Cornfield, Jill, Bankrate Survey: Just 4 in 10 Americans Have Savings They’d Rely on in an Emergency, Bankrate (2017).

5. Trends in Healthcare Payments Sixth Annual Report: 2015, InstaMed (May 2016).

6. Ibid.

7. Ibid.

8. Collier, Matthew, and Leslie Meyer Basham, Patient Loyalty: It’s Up for Grabs, Accenture, Washington, D.C. (2016).

9. More than 4 in 10 say they are dissatisfied with the total cost they pay for their healthcare (42%) and are worried about being able to pay medical costs for themselves and their family in the coming year (43%). 42% of consumers believe healthcare is the most unaffordable household expense. Americans’ Views on Current Trade and Health Policies, Politico-Harvard T.H. Chan School of Public Health (September 2016).

10. Hamel, Liz, et al., The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey, Kaiser Family Foundation (Jan. 5, 2016).

11. Anand, Pavi, Jenny Cordina, and Suzanne Rivera, Understanding Consumer Preferences Can Help Capture Value in the Individual Market, McKinsey & Company (2016).