Improving Value

Strategies to Address the Negative Effects of Health Care Consolidation

Competition in health care, while increasingly rare, helps control prices, encourages the delivery of high-quality products and services and promotes consumer choice. However, antitrust laws designed to preserve competition have been largely ineffective since the 1990s, and persistent consolidation among providers and insurers has contributed to high (and rising) health care costs. As a result, states have relied upon alternative approaches to mitigate anti-competitive effects after mergers occur.

Current Evidence on Health Care Consolidation

Health care organizations typically argue that mergers improve efficiency and create economies-of-scale, improving quality and reducing costs. Yet little reliable evidence supports this claim.1 In fact, ample evidence demonstrates that health care mergers increase prices and that less competition leads to lower quality.2,3 Mergers may also negatively affect other important aspects of the health care system, such as the health care workforce, health systems’ responsiveness to community concerns and access to care.4

State Options to Preserve or Increase Competition in Consolidated Markets

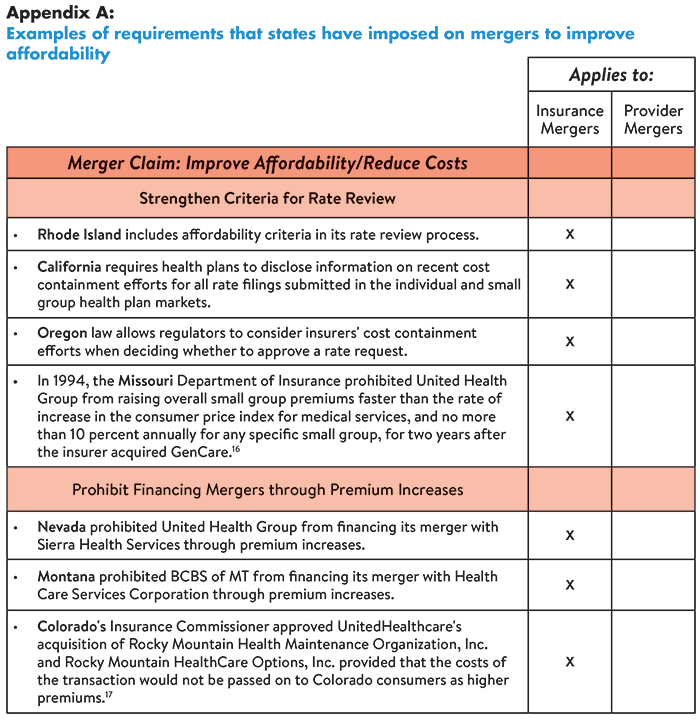

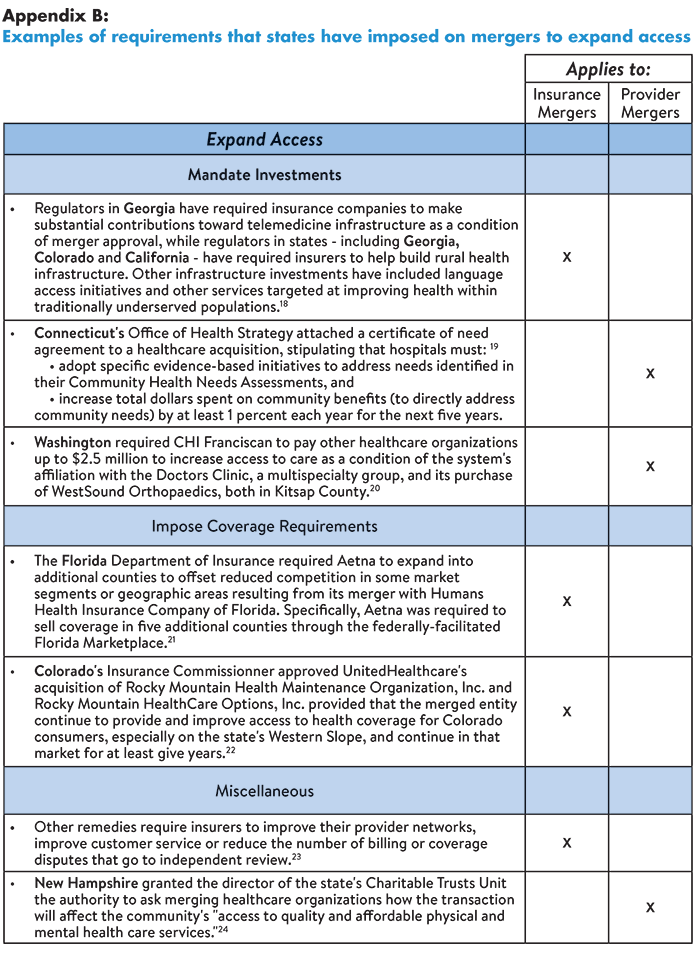

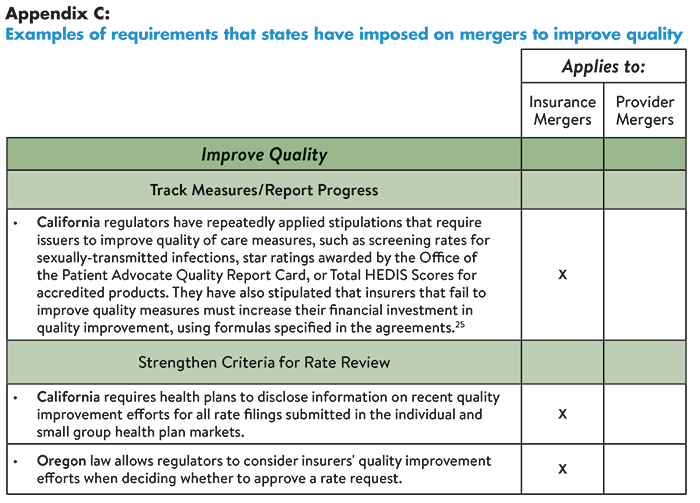

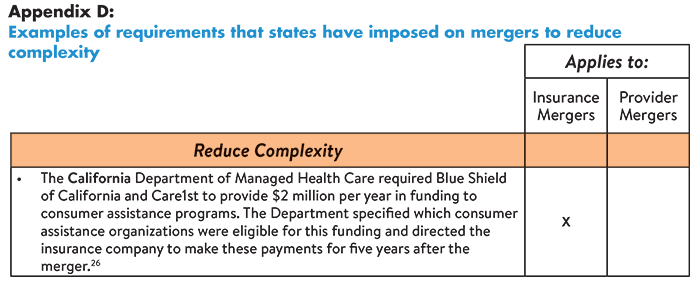

States can hold health care organizations accountable for delivering promised benefits by placing conditions on mergers designed to improve affordability, expand access, improve quality or reduce complexity. For example, some states have prohibited insurers from financing the cost of mergers by raising premiums. Others have required organizations to invest in consumer assistance programs, infrastructure development and quality improvement initiatives. Specific examples of these requirements are provided in Tables 1-4 (below, from Easy Explainer No. 16).

Alternatively, some states (including Tennessee, Virginia and North Carolina) have attempted to mitigate harmful effects of consolidation by issuing certificates of public advantage – legal agreements in which states exempt organizations from antitrust scrutiny in return for commitments to make public benefit investments and control health care cost growth.5 Evidence is emerging on the effectiveness of this strategy,6 however, a study of North Carolina’s experience documented substantial risks.7

Other strategies that states can pursue to restore competition in consolidated markets include:8,9

- Strengthening community benefit requirements for nonprofit hospitals as a condition of their tax exemption;

- Establishing “any willing provider” laws that require insurers to contract with all interested providers (thereby reducing the bargaining power of insurers);

- Establishing “any willing insurer” laws that require providers to contract with any willing insurer (thereby reducing the bargaining power of providers); and

- Increasing regulation/oversight through price caps or arbitration.10

Strategies to Prevent Future Consolidation

A 2017 study by The Commonwealth Fund revealed that 90 percent of provider markets and 60 percent of insurer markets were either highly or super-concentrated as of 2016.11 To prevent further consolidation, states should consider:

- Establishing/strengthening antitrust laws pertaining to horizontal mergers, vertical mergers and anti-competitive practices; and

- Examining state-level regulatory burdens that increase costs associated with compliance (further incentivizing providers to consolidate).

Notes

1. A few studies have documented modest price reductions after mergers among providers, however, the reliability of the data source used is debated. See: Webinar: Hospital Competition and Hospital Mergers: What the Best Evidence Tells Us (Sept. 4, 2019). See also: https://tobin.yale.edu/news/webinar-hospital-mergers-nonpartisan-research-experts

2. Ibid.

3. One study found that market concentration in the Medicare Advantage (MA) program was associated with higher premiums, however, the plans had a higher predicted probability of receiving a high-quality rating compared to MA plans sold in highly competitive markets. This finding suggests that a more nuanced approach than competition may be needed to ensure plan quality at the local market level. See: Adrion, Emily, “Competition and Health Plan Quality in the Medicare Advantage Market,” Health Services Research, Vol. 54, No. 5 (October 2019).

4. O’Hanlon (March 26, 2019).

5. Brown, Erin C. Fuse, Hospital Mergers and Public Accountability: Tennessee and Virginia Employ a Certificate of Public Advantage, Milbank Memorial Fund, New York, N.Y. (Sept. 26, 2018).

6. U.S. Federal Trade Commission, “FTC to Study the Impact of COPAs,” News Release (Oct. 21, 2019).

7. Brown, Erin C. Fuse, To Oversee or Not to Oversee? Lessons from the Repeal of North Carolina's Certificate of Public Advantage Law, Milbank Memorial Fund, New York, N.Y. (Jan. 17, 2018).

8. O’Hanlon (March 26, 2019).

9. Webinar: Hospital Competition and Hospital Mergers: What the Best Evidence Tells Us (Sept. 4, 2019). See also: https://tobin.yale.edu/news/webinar-hospital-mergers-nonpartisan-research-experts

10. Chernew, Michael E., Maximilian J. Pany, and Richard G. Frank, “The Case for Market-Based Price Caps,” Health Affairs Blog (Sept. 3, 2019).

11. Fulton, Brent D., Daniel R. Arnold, and Richard M. Scheffler, Market Concentration Variation of Health Care Providers and Health Insurers in the United States, The Commonwealth Fund, New York, N.Y. (July 30, 2018).

Notes from Appendices

18. Davenport, Karen, Advocates' Guide to Health Insurance Merger Remedies, Altarum (formerly Consumers Union) Healthcare Value Hub, Washington, D.C. (June 2016). f

19. Clary, Amy and Elinor Higgins, Oregon and Connecticut Hold Hospitals Accountable for Meaningful Community Benefit Investment, National Academy for State Health Policy, Washington, D.C. (Aug. 29, 2019).

20. Meyer, Harris, “Medical Group Deals Face Growing Antitrust Scrutiny as Price Worries Rise,” Modern Healthcare (July 6, 2019).

21. Davenport (June 2016).

22. Colorado Department of Regulatory Agencies, “Colo. Insurance Commissioner Approves UnitedHealthcare Acquisition of Rocky Mountain Health Plans,” News Release (Feb. 10, 2017).

23. Ibid. See also: Colorado Office of the Attorney General, “Antitrust Challenge and Settlement to the UnitedHealth Group and DaVita Merger will Safeguard Competition, Cost, and Quality of Healthcare for Seniors in the Colorado Springs Area,” News Release (June 19, 2019).

24. Doyle-Burr, Nora, “New N.H. Law Regulates Health Care Mergers,” Concord Monitor (Aug. 12, 2019).

25. Ibid.

26. Ibid.

- Hub Research Brief: Advocate's Guide to Health Insurance Merger Remedies (June 2016)

- Hub Research Brief: Addressing Consolidation in the Healthcare Industry (January 2016)

- Hub Webinar: Plan and Provider Consolidation: Better Coordination or Price Gouging? (January 2016)

- Hub Research Brief: A Primer: How Antitrust Law Affects Competition in the Healthcare Marketplace (April 2015)