Many Privately-Insured Respondents in the West Virginia and Surrounding Appalachian Counties (WVSAC) Region Receive Unexpected Medical Bills; Nearly One-Half Unhappy with Resolution, May Not Understand Options for Assistance

Unexpected medical bills are surprisingly common. They can take many forms, from higher-than-expected charges, to bills from unexpected doctors, to bills from out-of-network providers when patients thought they were in-network. Although the No Surprises Act went into effect in January 2022, consumers continue to receive surprise medical bills, indicating that there is still work to do to protect consumers and reduce patients’ financial burdens from these surprise bills.1

A 2022 survey of adults in the West Virginia and Surrounding Appalachian Counties (WVSAC) Region examined how prevalent these experiences were among these respondents. Though respondents reported receiving unexpected bills regardless of insurance status, this analysis focuses on the respondents with private health insurance (more than 450 responses), as those are the consumers who recently benefitted the most from the No Surprises Act.2 Prior to the No Surprises Act, consumers in West Virginia with employer coverage had no protections from surprise medical bills, while consumers who purchased their plans through the exchange had partial protections.3

Key Findings

- One in four (27%) of privately insured WVSAC Region respondents reported receiving a surprise medical bill;

- One-quarter (24%) of privately insured WVSAC Region respondents who reported receiving a surprise bill made an effort to resolve the bill before paying it;

- Over two in five (45%) of respondents reported that they ended up paying the bill in full;

- Only roughly one-third (31%) of respondents reported that their surprise medical bills were resolved satisfactorily;

Altogether, 27% of privately insured WVSAC Region respondents reported receiving a medical bill that included an unexpected expense in the prior 12 months. These respondents reported these specific issues:

- 55%—The amount charged was higher than expected

- 35%—A bill from a doctor they didn’t expect

Smaller numbers reported being charged out-of-network rates when they thought the doctor was in-network (9%); being charged for services they did not receive (8%) or reported something else unexpected (15%). The prevalence of unexpected bills in the WVSAC Region aligns well with national data; although, the prevalence of respondents being charged out-of-network rates when they

thought the doctor was in-network is slightly lower than national data from 2020.4 This could be due to the implementation of protections in the No Surprises Act—although early data show that the No Surprises Act has prevented more than two million potential surprise medical bills in January and February of 2022,5 survey data also show that consumers continue to receive surprise bills.6

WVSAC Region Respondents Tried a Number of Strategies to Address the Surprise Bill

Only about one-quarter (24%) of privately insured WVSAC Region respondents who received a surprise bill made an effort to resolve the bill before paying it. As a first step, 40% of respondents reported contacting their doctor, hospital or lab and 27% reported contacting their insurance plan to resolve their unexpected medical bill (Table 1). However, more than 1 in 10 privately insured WVSAC Region respondents who received a surprise medical bill reported paying the bill without disputing it, indicating that many respondents may not realize they have options for appealing these bills.

Only 15% of bill recipients reported taking more than one step to resolve their unexpected bill, which was most frequently contacting the insurer or provider. Very few reported taking actions that would escalate the issue beyond the insurer, doctor or hospital, such as:

- Contacting an insurance broker (10%)

- Contacting a state government agency (8%)

- Contacting a consumer assistance program (7%)

- Asking a friend of family member for help (7%)

- Filing a formal complaint (5%)

- Filing an insurance appeal (3%)

- Contacting a lawyer (2%)

- Contacting state legislators or member of Congress (1%)

It is likely that many patients may not realize these avenues of appeal are open to them. The survey also asked about respondents’ confidence in the skills needed to navigate the healthcare system. Areas where WVSAC Region respondents with private insurance particularly lacked confidence include disputing medical bills and resolving problems with unresponsive providers and health plans. Forty-five percent of respondents with private insurance said they had low confidence about disputing a medical bill that they perceived as incorrect. Relatedly, respondents reported low confidence about taking steps to fix it if their health plan (61%), doctor (52%) or hospital (55%) was not being responsive to their problem. These findings are consistent with other data showing that many adults have a poor understanding of how to navigate financial aspects of the healthcare system and lack critical knowledge, like knowing they have the right to appeal a coverage decision, how to seek help from state regulators and how to navigate hospital charity care policies.7

Among privately insured WVSAC Region respondents with an unexpected medical bill in the past 12 months, over one-third (45%) reported that they ultimately paid the bill in full or through a payment plan. Just 10% reported that they were able to negotiate a lower price, and still fewer reported having their bill dismissed (7%), while 7% reported that their surprise medical bill went to a collections agency and was still unpaid. (Table 2).

A third of unexpected medical bills were not resolved satisfactorily; many remain unresolved.

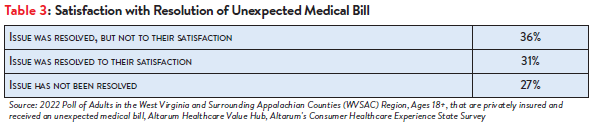

Among privately insured WVSAC Region respondents who had an unexpected medical bill, just about a third (31%) indicated that the issue was resolved to their satisfaction. Greater than one-third (36%) indicated that the issue was not resolved to their satisfaction and over a quarter (27%) considered the issue unresolved. (Table 3)

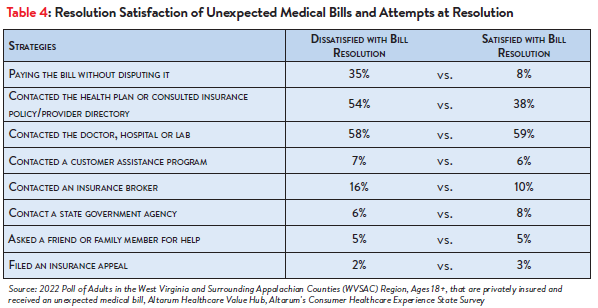

More respondents (54%) who reported being dissatisfied with their surprise bill resolution reported that they contacted their health plan or consulted their insurance policy/provider director than those who were satisfied with their bill resolution (38%), although over a third of each category undertook this action (Table 4). Both satisfied and dissatisfied respondents reported: contacting the doctor, hospital or lab; contacting a customer assistance program; contacting a state government agency; and asking a friend or family member for help in roughly equal amounts. Few respondents filed an appeal with their insurance provider.

However, dissatisfied respondents more often reported paying their surprise bill without disputing it than those who were satisfied with their bill resolution.

Discussion

Privately insured WVSAC Region respondents receive unexpected medical bills in high numbers, despite recent federal protections. The nature of these bills takes many forms, from higher-than-expected charges, to bills from doctors they didn’t expect, to surprise out-of-network bills. Distressingly, more than a third of these unexpected bills are not resolved to the satisfaction of the recipient.

This report shows that survey respondents may have “tried to do the right thing,” with more than half (53%) reporting that they made an initial effort to resolve the unexpected bill by contacting the doctor, hospital or lab. Very few respondents reported escalating their concerns to formal appeal channels, such as contacting a state government agency (8%), filing a formal complaint (5%) or filing an insurance appeal (3%). As states and the federal government work together to enforce the protections of the No Surprises Act, they are emphasizing the need to get the consumer out of the middle. The No Surprises Act shields consumers from many aspects of surprise medical bills and removes them from payment disagreements between their providers and health insurers by creating specific arbitration processes. This arbitration process uses an independent dispute resolution approach, in addition with guardrails to limit its use and reduce the likelihood of large awards that may impact consumer premiums.8 However, the No Surprises Act defers to existing state mechanisms for dispute resolution, in states with existing surprise billing protections.

Despite the passage of the No Surprises Act, there is still opportunity for states to protect consumers. For instance, the No Surprises Act does not invalidate state laws that are more protective of consumers; for instance, many states have implemented surprise billing legislation that explicitly protects consumers from balance bills resulting from ground ambulance services, which are not covered under the federal law.9 Additional states’ protections include stipulations on bills concerning urgent care centers or lab services. While West Virginia offers protections for ground ambulance services, it does not protect against bills associated with urgent care centers or lab work services. Other efforts states are undertaking to protect consumers from surprise medical bills include educating consumers about their rights and opportunities to dispute surprise medical bills, simplifying health plan benefit designs10 and improving the accuracy of provider directories and adequacy of provider networks. In light of survey results showing that bill recipients may not understand how to escalate their billing problems, West Virginia policymakers may also want to consider creating a dedicated state ombudsman’s office to help consumers with their billing problems, such as available in Connecticut and Vermont.11

Notes

- The No Surprises Act is a landmark law that will shield consumers from many aspects of surprise medical bills— beginning on January 1, 2022, providers may not bill patients for more than the in-network cost-sharing due under patients’ insurance in almost all scenarios with the potential for surprise out-of-network bills. While many of these scenarios include emergency care, when patients have little input on whether they receive care at an in-or out-of-network facility, the No Surprises Act also applies to elective care scenarios when patients do not have control over whether their care team includes out-of-network providers. The No Surprises Act shields consumers from many aspects of surprise medical bills and removes them from payment disagreements between their providers and health insurers by creating specific arbitration processes. This arbitration process uses an independent dispute resolution approach, in addition with guardrails to limit its use and reduce the likelihood of large awards that may impact consumer premiums. However, the No Surprises Act defers to existing state mechanisms for dispute resolution, in states with existing surprise billing protections.

- These privately insured respondents include those covered by plans regulated at the state level (“fully insured” plans), as well as plans regulated by the U.S. Department of Labor (ERISA or “self-insured” plans). The later are typically the plans offered by larger employers.

- The surrounding Appalachian counties in this region are in Maryland, Pennsylvania, Ohio, Virginia and Kentucky, who, before the No Surprises Act, had comprehensive, partial, comprehensive, comprehensive and zero surprise billing protections, respectively.

- A 2020 Kaiser Family Foundation Survey found that one in 5 insured adults has a surprise medical bill in the past two years—19% of those reporting a surprise medical bill received the surprise bill because the provider was out of network. In addition, A Kaiser Family Foundation survey finds that among insured, non-elderly adults struggling with medical bill problems, charges from out-of-network providers were a contributing factor about one-third of the time. A study by Stanford researchers found that 43% of visits to emergency rooms resulted in surprise medical bills. https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2740802?guestAccessKey=9fba6e0c-f029-401a-9675-737db3e67b5d&utm_source=For_The_Media&utm_medium=referral&utm_campaign=ftm_links&utm_content=tfl&utm_term=081219

- More Than 2 Million Surprise Bills Avoided During January-February 2022, AHIP (May 2022). https://ahiporg-production.s3.amazonaws.com/documents/202205-AHIP-BCBSA_NSA-Survey-v02.pdf

- “Surprise Medical Bills Have Been Banned Since January. 1 in 5 Americans Say They or Their Family Have Gotten an Unexpected Charge Anyway,” Morning Consult (July 7, 2022). https://morningconsult.com/2022/07/07/surprise-medical-billing-ban-unexpected-charges/

- A 2014 KFF survey found one-third of respondents did not know that if a health plan refuses to pay for a medically recommended service, an insured person has the right to appeal the plan’s decision. https://www.kff.org/health-reform/poll-finding/assessing-americans-familiarity-with-health-insurance-terms-and-concepts/.A separate 2015 survey found three-quarters of privately-insured adults are unsure if they have the further right to appeal to the state/an independent medical expert if their health plan refuses coverage for medical services they think they need. Few (just 13%) could identify the state agency/department tasked with handling health insurance complaints. https://consumersunion.org/research/surprise-bills-survey/

- No Surprises Act: A Federal-State Partnership to Protect Consumers from Surprise Medical Bills, The Commonwealth Fund (Oct. 20, 2022). https://www.commonwealthfund.org/publications/fund-reports/2022/oct/no-surprises-act-federal-state-partnership-protect-consumers

- Ibid.

- For examples, see Corlette et. al. Missed Opportunities: State-Based Marketplaces Fail to Meet Stated Policy Goals of Standardized Benefit Designs, Urban Institute (July 2016).

- Hunt, Amanda, The Office of the Healthcare Advocate: Giving Consumers a Seat at the Table, Healthcare Value Hub Research Brief No. 25 (May 2018). https://healthcarevaluehub.org/advocate-resources/publications/office-healthcare-advocate-giving-consumers-seat-table

Methodology

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ unbiased views on a wide range of health system issues, including confidence using the health system, financial burden and possible policy solutions.

This survey, conducted from September 26 to November 4, 2022, used a web panel from online survey company Dynata with a demographically balanced sample of approximately 1,227 respondents who live in West Virginia and surrounding Appalachian counties. The survey was conducted in English or Spanish and restricted to adults ages 18 and older. Respondents who finished the survey in less than half the median time were excluded from the final sample, leaving 1,127 cases for analysis. After those exclusions, the demographic composition of respondents was as follows, although not all demographic information has complete response rates: