Colorado Residents Worried about High Hospital Costs

While hospitals are important providers of healthcare and vital members of our communities, a poll of Colorado adults, conducted from Dec. 20, 2018 to Jan. 2, 2019, finds there is great concern about hospital costs as well as a desire to enact solutions.

For context, nationally only about 7% of the adult population stays overnight in the hospital in any given year.1 A far greater number visit the emergency department (ED), often without being admitted for an overnight stay. In 2017, 20% of Colorado adults visited an ED, and some of those patients end up being admitted.2

Hardship and Worry about Hospital Costs

Many Colorado residents are currently experiencing hardship due to hospital costs. Ten percent of respondents had trouble affording their hospitalization in the past 12 months.

Even more are worried about affording healthcare in the future. Two-thirds (66%) of all survey respondents reported being either “worried” or “very worried” about affording the cost of hospital care from a serious illness or accident.

Skills Navigating Hospital Care

Colorado adults report being fairly confident in terms of knowing when to seek emergency care but are less confident in their ability to find quality information or fix a problem with the hospital. The share reporting they are very or extremely confident:

- 65%—knowing when to seek care in the hospital emergency department vs their primary care physician

- 50%—can find quality ratings for hospitals.

- 41%—know what steps to take to address a problem they were having with their hospital stay or bill.

- Furthermore, respondents expressed a willingness to seek out hospital price and quality information:

- 22%—tried to find out the cost of a hospital stay ahead of time.

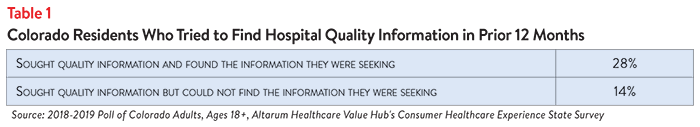

- 42%—tried to find quality information about hospitals, although not always successfully (see Table 1).

But other data from the survey suggests that these efforts aren’t always successful in keeping consumers safe from surprise medical bills. When asked about surprise bills, about half (53%) of those reporting unexpected medical bills said that at least one such bill came from a hospital.3

Support for Hospital-Related “Fixes” Across Party Lines

Hospitals, along with drug manufacturers and insurance companies, were viewed as contributing to high costs. When given more than 20 options, the options cited most frequently as being a “major reason” for high healthcare costs were:

- 74%—Drug companies charging too much money

- 71%—Hospitals charging too much money

- 70%—Insurance companies charging too much money

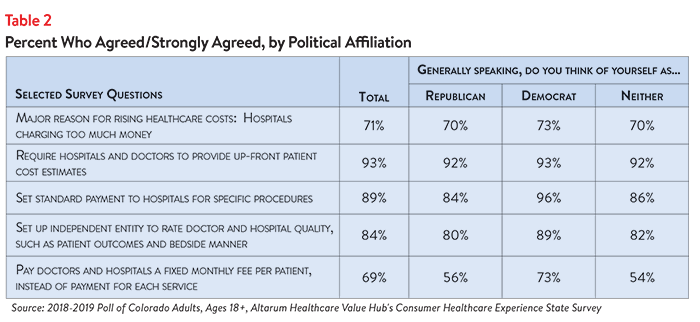

Across party lines, respondents strongly endorsed a number of hospital-related strategies:

- 93%—Require hospitals and doctors to provide up front patient cost estimates4

- 89%—Set standard payment to hospitals for specific procedures

- 84%—Set up an independent entity to rate doctor and hospital quality, such as patient outcomes and bedside manner

- 69%—Pay doctors and hospitals a fixed monthly fee per patient, instead of payment for each service

Discussion

In Colorado (as in other states), hospital spending is significant—representing 34% of total health spending.5 Of concern, the Colorado Department of Health Care Policy and Financing has reported high price growth for this sector.6 Moreover, state data shows that capital expenditures for the hospital industry in Colorado were higher than almost all other states, with state officials likening it to an “arms race.”7 At the same time, Colorado’s hospitals show large profit margins, enabling them to amass billions in reserves.8

The findings from this poll suggest Colorado consumers are highly motivated when it comes to searching for hospital care. However, respondents express a strong support for new price and quality transparency tools to help them better navigate hospital care.

Importantly, transparency approaches, combined with consumer shopping, are not deemed by respondents as sufficient to address their grave healthcare affordability concerns. Stronger measures are also needed. Some specific approaches were included in the survey (see Table 2, above) but policymakers should look at the full suite of evidence-based options in order to be fully responsive to Colorado adults’ strong, bi-partisan call for governmental action.

Notes

1. National Health Interview Survey, Summary Health Statistics (2016).

2. Colorado Health Access Survey, Use of Health Care (September 2017).

3. Respondents could select more than one option for the source of their surprise bill.

4. Colorado has a law that went into effect in January 2018 that mandates hospitals to post the self-pay prices of common procedures but one observer notes “in searching for prices at two acute care hospitals in the state, it’s difficult to make an apple-to-apple comparison.” Prices will not reflect the total amount a patient may owe after receiving healthcare services- potentially excluding professional physician fees, medications, medical devices, or rehab or home health services. See: https://www.healthcarefinancenews.com/news/colorado-signs-law-mandatinghospitals-post-self-pay-prices

5. Colorado Hospital Association and the Colorado Health Institute, from Affordability in Colorado, page 4.

6. Osher, Christopher, “Coloradans Pay More as Hospital Building Spree Leads to Empty Beds and Profits Nearly Twice the National Average,” The Denver Post (Oct. 4, 2018).

7. Ibid.

8. Ibid.

Methodology

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ unbiased views on a wide range of health system issues, including confidence using the health system, financial burden, and views on fixes that might be needed.

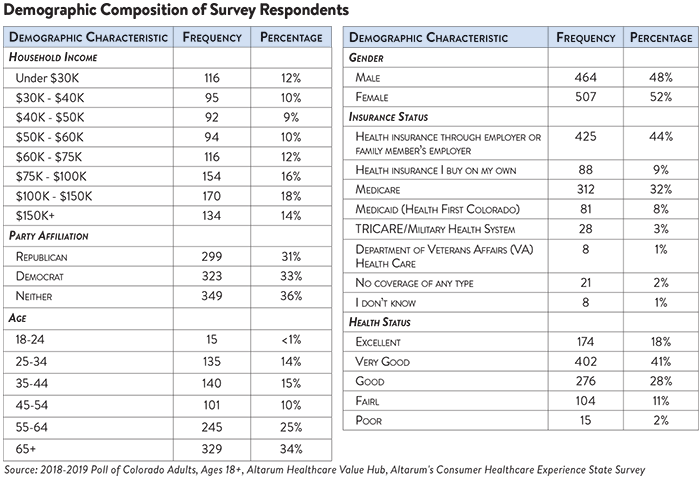

The survey used a web panel from SSI Research Now containing a demographically balanced sample of approximately 1,000 respondents who live in Colorado. The survey was conducted only in English and restricted to adults ages 18 and older. Respondents who finished the survey in less than half the median time were excluded from the final sample, leaving 971 cases for analysis with sample balancing occurring in age, gender and income to be demographically representative of Colorado. After those exclusions, the demographic composition of respondents is as follows.