Colorado Survey Respondents Worry about High Hospital Costs, Have Difficulty Estimating Quality and Cost of Care; Express Bipartisan Support for Government Action

Hospitals provide essential services and are vital to the well-being of our communities. However, a survey

of more than 1,400 Colorado adults, conducted from March 26 to April 12, 2024, revealed widespread

concern about hospital costs and bipartisan support for government-led solutions.

Hardship and Worry About Hospital Costs

Eighty-three percent (83%) of Colorado respondents reported being worried about affording health care

both now and in the future. Likewise, 37% reported experiencing a cost burden due to medical bills, and

nearly two in every three (63% of) respondents reported being “worried” or “very worried” about

affording medical costs in the event of a serious illness or accident. These concerns may be justified — of

the 24% of respondents who reported receiving an unexpected medical bill in the past year, 45% say that

at least one came from a hospital.

Skills Navigating Hospital Care, Cost and Quality Information

Colorado respondents are fairly confident in their ability to recognize when to seek emergency care.

Sixty-two percent (62%) of respondents are very or extremely confident that they know when to visit the

emergency department as opposed to an urgent care center or a primary care provider. However, they

are less confident in their ability to find hospital costs and quality information. Fifty-two percent (52%) of

respondents are not confident in their ability to find the cost of a procedure in advance, and half lack

confidence in their ability to find quality ratings for doctors (52%) or hospitals (51%).

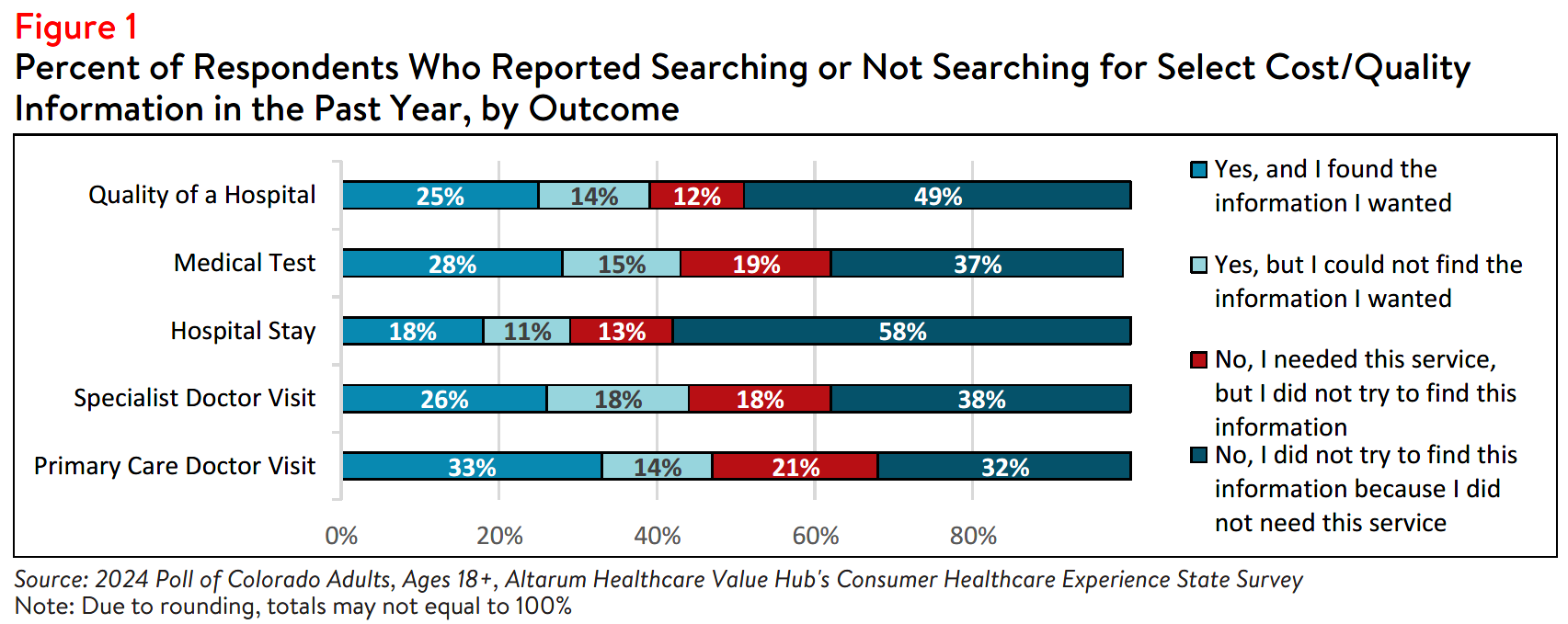

Those figures may be reflected in the low rates of searching for hospital price and quality information.

Only 29% of all respondents attempted to find the cost of a hospital stay ahead of time, and 13% needed a hospital stay but did not search for cost information (see Figure 1). Among the respondents who tried to

find hospital cost information or needed a hospital stay, 42% were able to find the information they

needed; 27% attempted to find hospital cost information but were unsuccessful; and 31% did not attempt

to find information when they needed a hospital (see Figure 1).

Similarly, fewer than two in five (39% of) respondents reported searching for hospital quality information,

and 12% reported needing a hospital stay but not searching for quality information (see Figure 1). Of those who did search for hospital quality information or needed a hospital stay, 49% were successful in their search; 27% searched for hospital quality information but were unsuccessful; and 23% did not attempt to find quality information despite needing a hospital stay (see Figure 1).

Despite federal price transparency mandates for hospitals, hospital costs and quality ratings are still not

always accessible.1 This is reflected in the most frequently cited reasons respondents gave for not

searching for cost or quality information, which include:

- 33% — They followed their doctors’ recommendations or referrals;

- 28% — Looking for information felt confusing or overwhelming;

- 27% — They did not know where to look;

- 19% — They did not have time to look; and

- 18% — It did not occur to them to look for provider quality or price information.

Notably, a small number of respondents reported that cost or quality is not important to them (12% and

4%, respectively).

Respondents who were unsuccessful in their search for hospital cost information described several

challenges. Forty-seven percent (47%) reported that the available cost information was confusing; 36%

reported that their provider or hospital would not provide a price estimate; 33% reported that their

insurer would not provide a price estimate; and 33% reported that the price information was insufficient.

Likewise, among respondents who were unsuccessful in their search for hospital quality information, 29%

reported that the resources were confusing, and 20% reported that the quality information was not

sufficient.

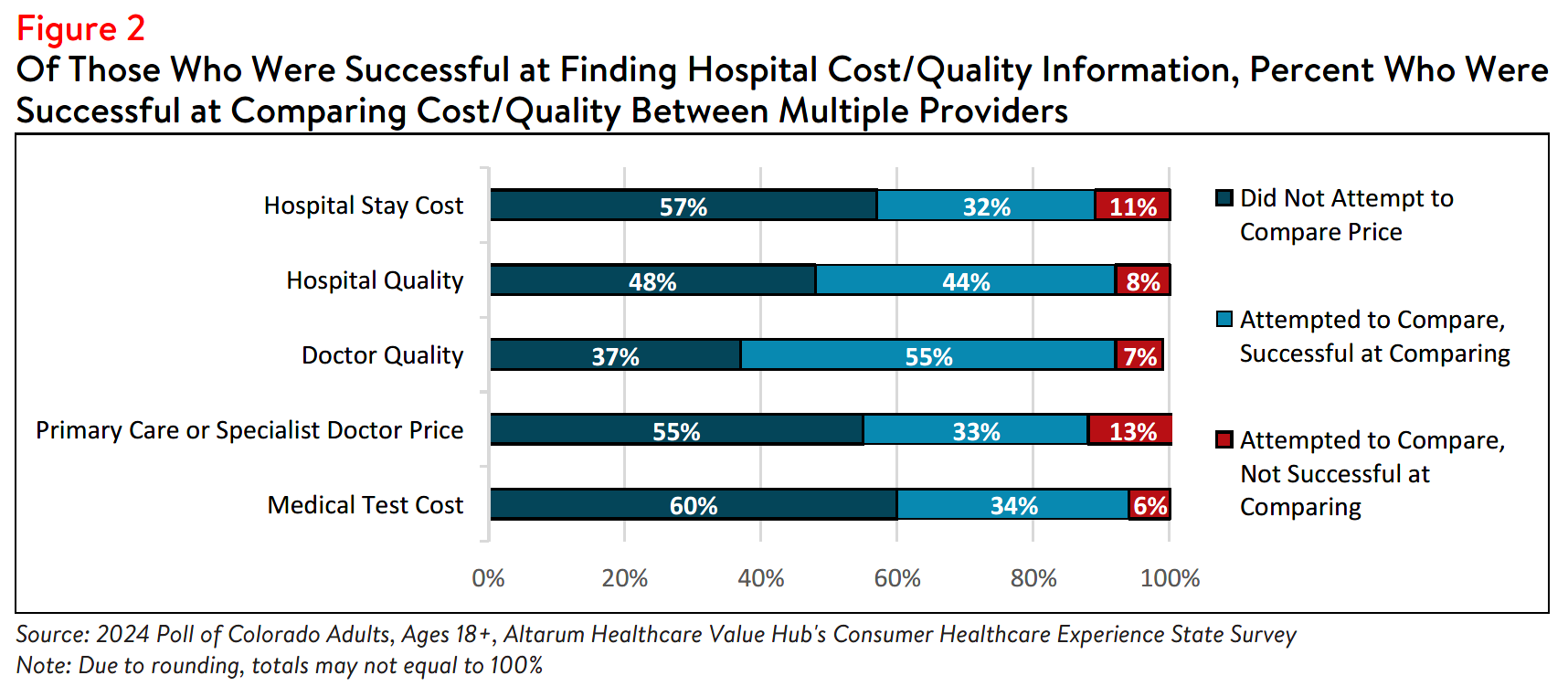

However, among those who were successful in their search for cost or quality information, 32% reported

they were able to find enough information to successfully compare the costs of a hospital stay between

two or more options, and 44% reported finding enough information to compare quality ratings across

hospitals (see Figure 2). Many of these respondents reported that the comparison ultimately influenced

their choice of which provider to seek care from. Seventy-six percent (76%) of respondents who

compared the cost of a primary care or specialist doctor visit, 86% of those who compared the cost of

medical test providers and 89% of those who compared the cost of a hospital stay reported that the

comparison influenced their choice of hospital or provider. Likewise, 85% of respondents who searched

for hospital quality information reported that the comparison influenced their decision of hospital.

Impact of and Worry Related to Hospital Consolidation*

In addition to the above healthcare affordability burdens, a small share of Colorado respondents reported

being negatively impacted by health system consolidation. Between 2018 to 2023, there have been 4

changes in ownership involving hospitals through mergers, acquisitions, or CHOW in Colorado.2,3

Colorado requires that the State Attorney General be notified of all hospital transactions but does not

grant the authority to approve or deny transactions.4 However, the state does require that nonprofit

hospitals must provide annual reports indicating that the change in ownership has not negatively impacted

access to health services in the affected communities for five years following the transaction.

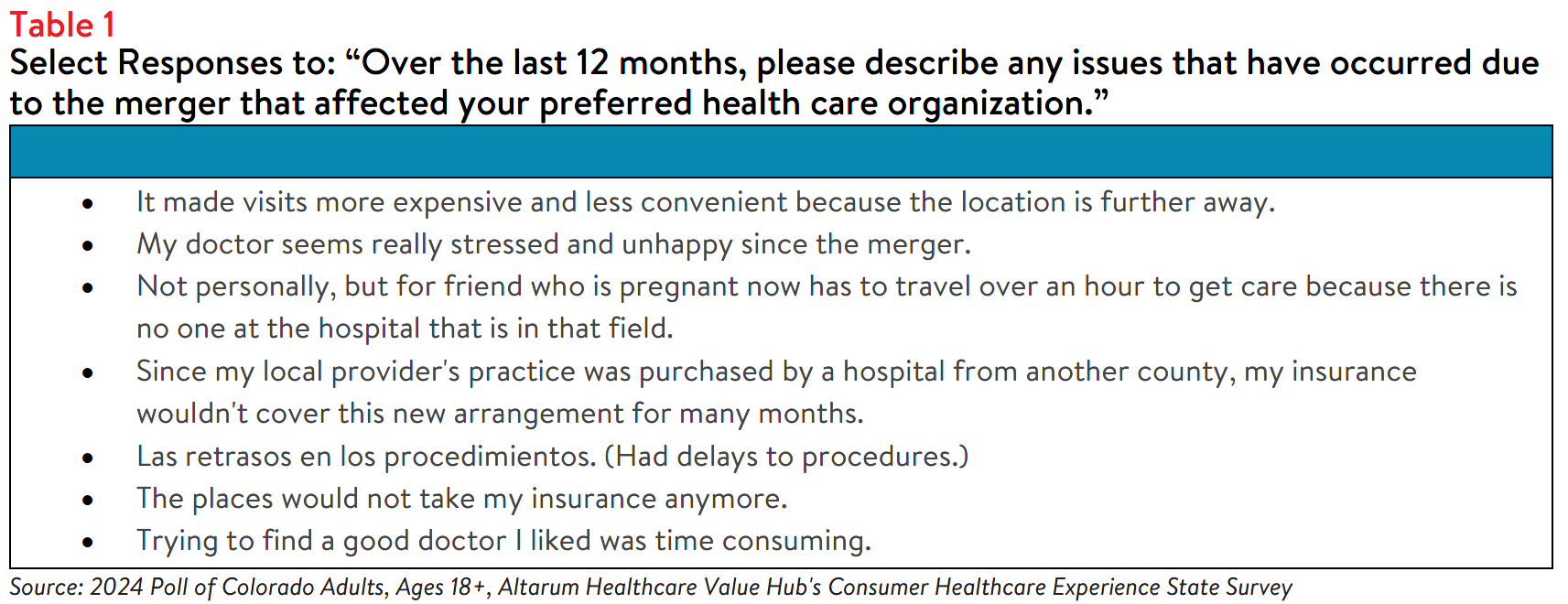

In the past year, 32% of respondents reported that they were aware of a merger or acquisition in their

community—of those respondents, 19% reported that they or a family member were unable to access

their preferred health care organization because of a merger that made their preferred organization out-

of-network. Out of those who reported being unable to access their preferred healthcare provider due to

a merger:

- 43% — delayed or avoided going to the doctor or having a procedure done because they could no longer access their preferred health care organization due to a merger;

- 37% — skipped recommended follow-up visits due to a merger;

- 36% — changed their preferred doctor or hospital to one that is in-network;

- 19% — have changed their preferred provider due to a merger resulting in a service closure;

- 17% — changed their health plan coverage to include the preferred doctor or hospital;

- 17% —stayed with their preferred health care provider and now pay out-of-network prices; and

- 17% — have switched to telehealth options to continue seeing their preferred provider.

Out of those who reported that the merger caused an additional burden for them or their families, the top

three most frequently reported issues were:

- 30% — The merger created an added financial burden

- 27% — The merger created a gap in the continuity of my care

- 26% — The merger created an added wait time when searching for a new provider

While a smaller portion of respondents reported being unable to access their preferred health care

organization because of a merger, far more respondents (57%) reported being somewhat, moderately or

very worried about the impacts of mergers in their health care organizations. When asked about their

largest concern respondents most frequently reported:

- 29% — I’m concerned I will have fewer choices of where to receive care

- 26% — I’m concerned I will have to pay more to see my doctor

- 25% — I’m concerned my doctor may no longer be covered by my insurance

- 10% — I’m concerned I will have a lower quality of care

- 9% — I’m concerned I will have to travel farther to see my doctor

To further examine the impact of health system consolidation on Colorado residents, survey respondents

were also asked to share their experiences seeking care following a merger, acquisition or other change of ownership (see Table 1).

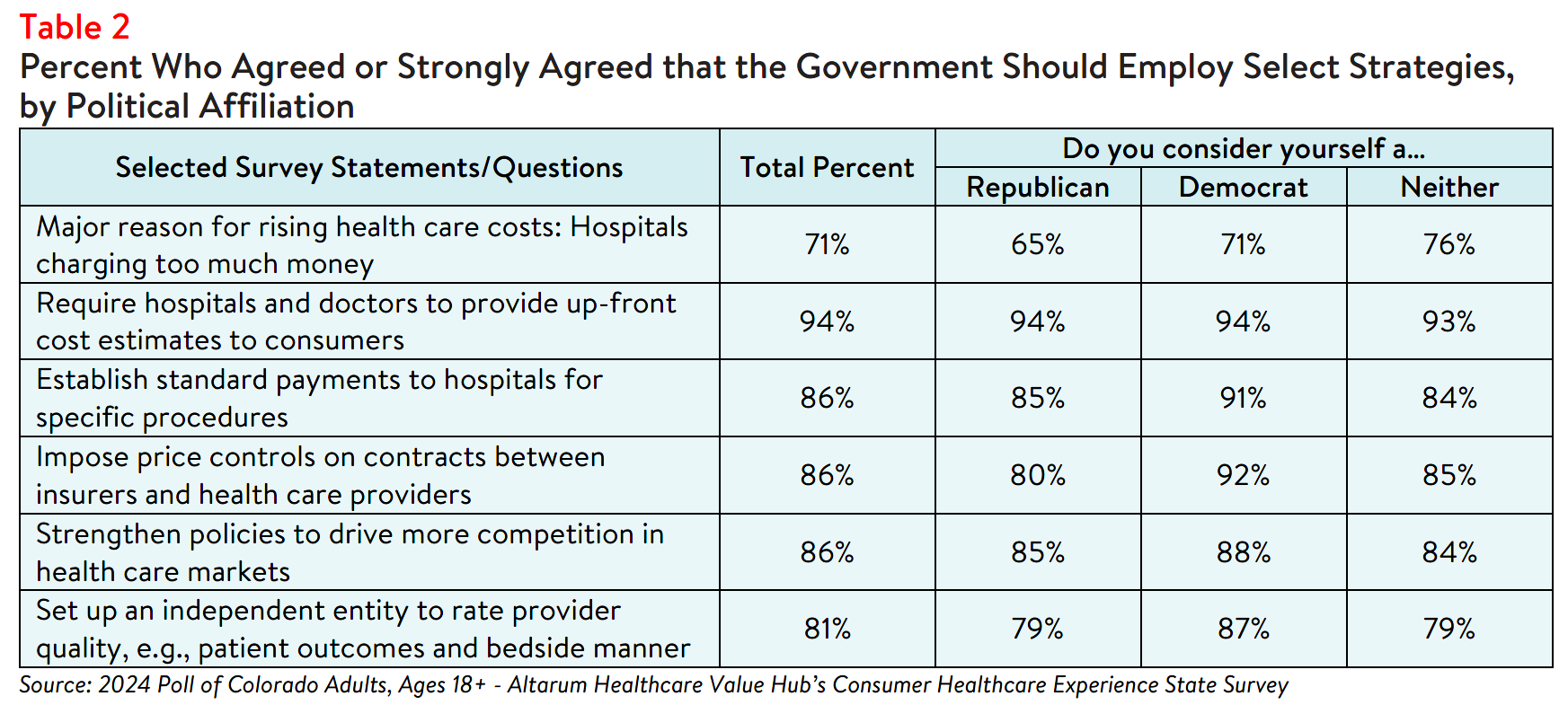

Support for Solutions Across Party Lines

Hospitals, along with drug manufacturers and insurance companies, are viewed as a primary contributor to high health care costs. Out of fifteen possible options, Colorado respondents most frequently reported

believing that the reason for high health care costs is unfair prices charged by powerful industry

stakeholders, such as:

- 79% — Drug companies charging too much money

- 71% — Hospitals charging too much money

- 71% — Insurance companies charging too much money

- 55% — Large hospitals or physician groups using their influence to increase payments from insurance companies

Respondents endorsed a number of strategies to address high health care costs, including:

- 94% — Require hospitals and doctors to provide up-front cost estimates to consumers;

- 87% — Set standard payments to hospitals for specific procedures;

- 86% — Impose price controls on contracts between insurers and health care providers;

- 86% — Strengthen policies to drive more competition in health care markets; and

- 81% — Establish an independent entity to rate doctor and hospital quality.

Conclusion

The poll findings indicate that while some Colorado respondents are motivated to search for hospital cost

and quality information to inform their decisions and plan for future medical expenses, over half did not

seek this information at all. This suggests that price transparency initiatives alone may not effectively

influence consumer behavior.

Unsurprisingly, Colorado respondents strongly support government-led solutions to make price and

quality information more accessible and to help consumers navigate hospital care. Many favored solutions

would reduce the burden on consumers, such as standardizing payments for specific procedures, requiring cost estimates from hospitals and doctors, and establishing an independent entity for quality reviews. Policymakers should consider these and other policy options to address the bipartisan call for government action.

Notes

-

As of January 1, 2021, the Centers for Medicare and Medicaid Services (CMS) requires hospitals to make public a machine-readable file containing a list of standard charges for all items and services provided by the hospital, as well as a consumer-friendly display of at least 300 shoppable services that a patient can schedule in advance. However, Compliance from hospitals has been mixed, indicating that the rule has yet to demonstrate the desired effect. https://www.healthaffairs.org/content/forefront/hospital-price-transparency-

progress-and-commitment-achieving-its-potential -

Centers for Medicare and Medicaid Services. (2023). Hospital Change of Ownership. Retrieved June 5, 2024, from

https://data.cms.gov/provider-characteristics/hospitals-and-other-facilities/hospital-change-of-ownership. -

A CHOW typically occurs when a Medicare provider has been purchased (or leased) by another organization. The CHOW results in the transfer of the old owner's identification number and provider agreement (including any Medicare outstanding debt of the old owner) to the new owner…An acquisition/merger occurs when a currently enrolled Medicare provider is purchasing or has been purchased by another enrolled provider. Only the purchaser's CMS Certification Number (CCN) and tax identification number remain.

Acquisitions/mergers are different from CHOWs. In the case of an acquisition/merger, the seller/former owner's CCN dissolves. In a CHOW, the seller/former owner's CCN typically remains intact and is transferred to the new owner. A consolidation occurs when two or more enrolled Medicare providers consolidate to form a new business entity. Consolidations are different from acquisitions/mergers. In an acquisition/merger, two entities combine but the CCN and tax identification number (TIN) of the purchasing entity remains intact. In a consolidation, the TINs and CCN of the consolidating entities dissolve and a new TIN and CCN are assigned to the new,consolidated entity. Source: Missouri Department of Health and Senior Services, Change of Ownership Guidelines—Medicare/State Certified Hospice. Retrieved August 23, 2023, from https://health.mo.gov/safety/homecare/pdf/CHOW-Guidelines-

StateLicensedHospice.pdf#:~:text=Acquisitions%2Fmergers%20are%20different%20from%20CHOWs.%20In%20the%20case,provider

s%20consolidate%20to%20form%20a%20new%20business%20entity. -

The Source on Health Care Price and Competition, Merger Review, Retrieved August 23, 2024 from https://sourceonhealthcare.org/market-consolidation/merger-review/

Methodology

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ views on a wide range of health system issues, including confidence using the health system, financial burden and possible policy solutions. This survey, conducted from March 26 to April 12, 2024, used a web panel from Dynata with a demographically balanced sample of approximately 1,500 respondents who live in Colorado. Information about Dynata’s recruitment and compensation methods can be found here. The survey was conducted in English or Spanish and restricted to adults ages 18 and older. Respondents who

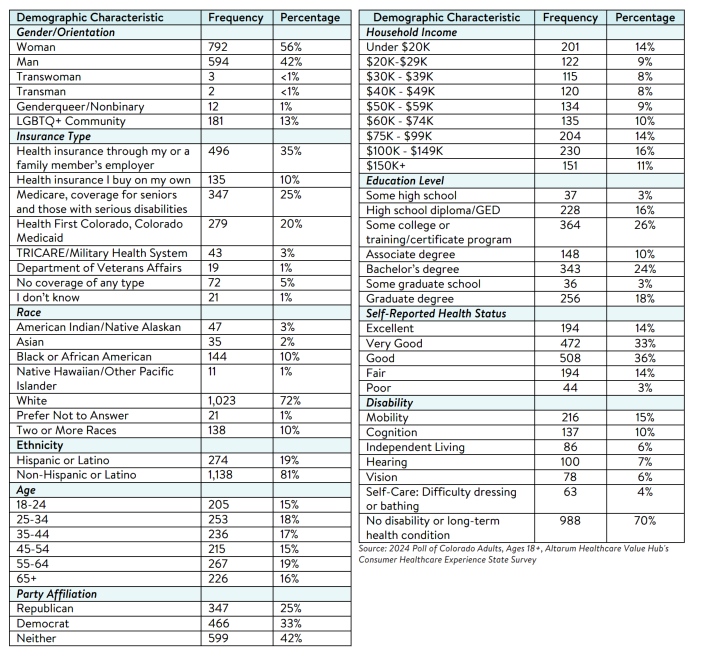

finished the survey in less than half the median time were excluded from the final sample, leaving 1,412 cases for analysis. After those exclusions, the demographic composition of respondents was as follows, although not all demographic information has complete response rates: