Colorado Survey Respondents Face Challenges Navigating the Health Care System, Understanding Cost-Sharing Obligations; Express Bipartisan Support for Government Action

A 2024 survey of more than 1,400 Colorado adults, conducted from March 26 to April 12, 2024, found

that many respondents face challenges confidently navigating the health care system and understanding

their cost-sharing obligations. These challenges are sometimes attributed to insufficient levels of health

insurance literacy or health literacy, which is associated with poorer health outcomes, lower patient

satisfaction and higher costs.1,2,3 This brief surfaces respondents’ experiences operating within the health

care system, interpreting their cost-sharing obligations and highlights support for related policy solutions.

Confidence in Obtaining Care, Understanding Costs, Resolving Issues

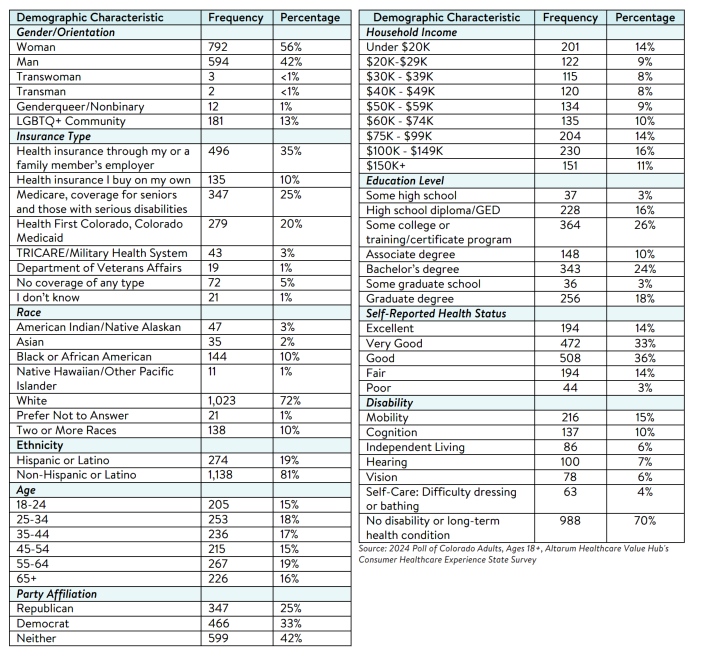

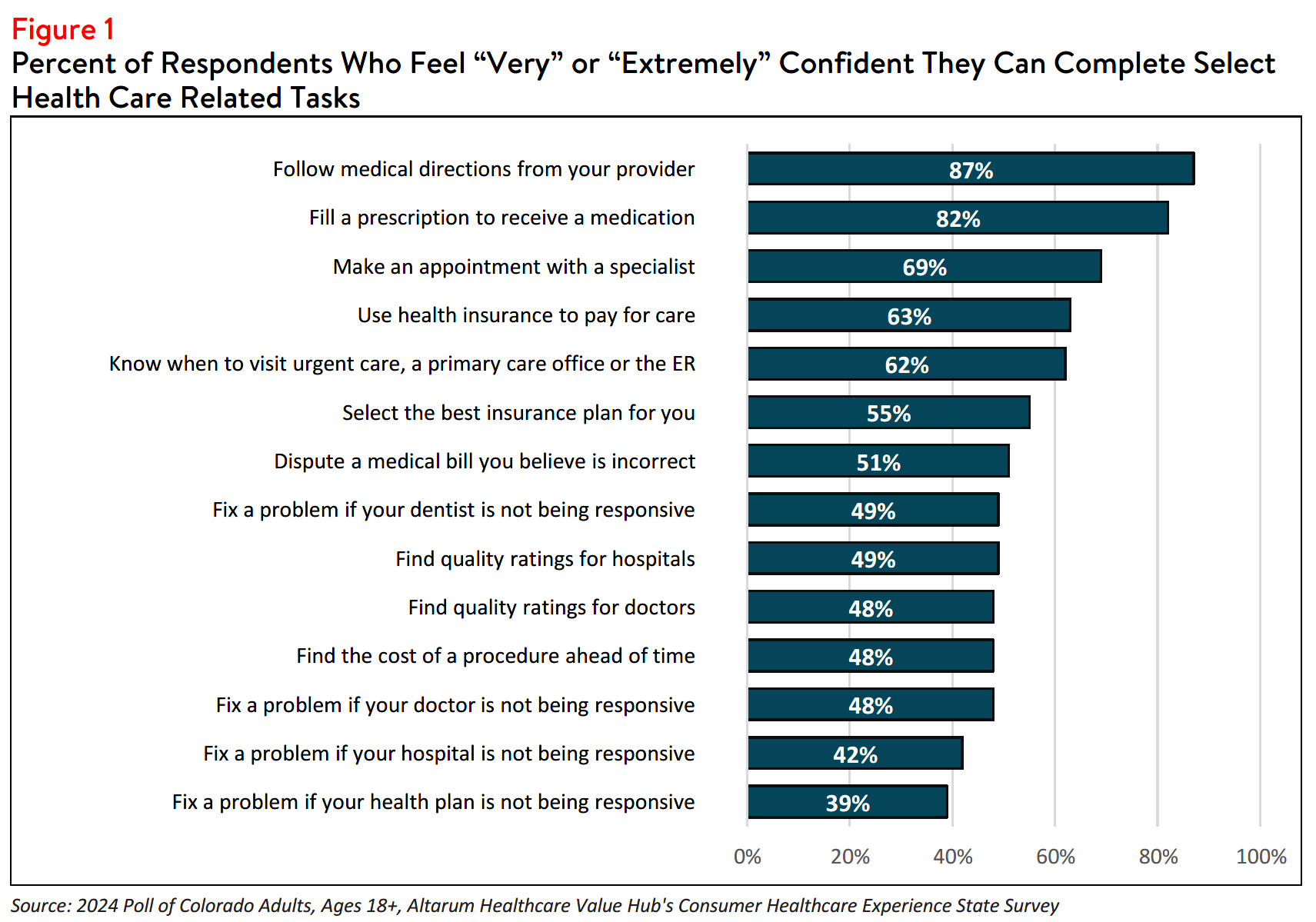

Many Colorado respondents report being confident in their ability to fill a prescription or follow directions

provided by their doctor. However, fewer are confident in their ability to resolve concerns related to

financial obligations, such as disputing a medical bill or determining how much a procedure may cost. For

example, fewer than two in five (39% of) respondents feel very or extremely confident they could resolve

an issue if their a health plan was not responsive to their concerns (see Figure 1).

Finding/Interpreting Health Care Cost and Quality Information

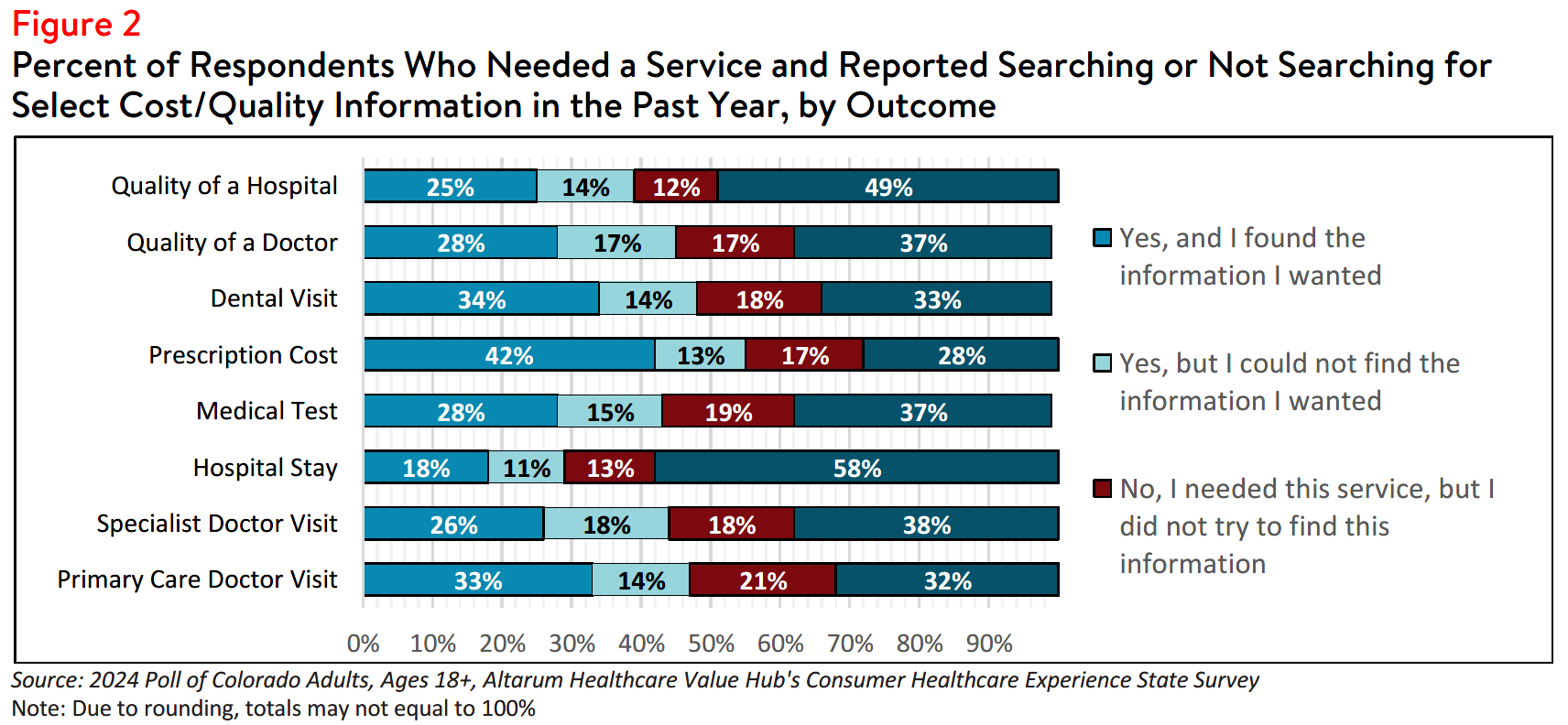

Limited knowledge of health care quality or costs can hinder consumers' ability to budget for care, which

can be especially detrimental to the under- and uninsured.4 Among Colorado respondents, fewer than half

(48%) of respondents feel confident in their ability to find the cost of a procedure in advance. In fact,

among those who reported that they did not search for cost or quality information before a required

procedure, 28% reported that the act of looking for information felt confusing or overwhelming, and 27%

reported that they did not know where to look.

Although most respondents who searched for cost or quality information were successful, there were

some who reported that they were unable to find the information they needed (see Figure 2). Nearly half

(47%) of respondents who searched for, but could not find hospital cost information, reported that the

available cost information was confusing, 36% reported that their provider or hospital would not provide a

price estimate, 33% reported that their insurer would not provide a price estimate and 33% reported that

the price information was insufficient.

Likewise, among respondents who were unsuccessful in their search for hospital quality information, 29%

reported that the resources were confusing, and 20% reported that the quality information was not

sufficient. Notably, a small number of respondents reported that cost or quality is unimportant to them

(12 and 4%, respectively). These challenges persist despite federal hospital price transparency mandates.5

Research shows little correlation between the quality and the price of medical services.6

However, 39% of respondents reported that they would be willing to pay more to see a doctor with higher quality rankings. Additionally, when asked to choose from a five-point scale ranging from “not at all important” to “extremely important,” 60% of Colorado respondents reported that the out-of-pocket costs would be either a “very” or “extremely” important deciding factor if when choosing between two providers with similar quality ratings. Likewise, 60% reported that quality ratings are an important factor when deciding between two physicians providing services for the same price.

Difficulty Understanding Common Health Care Terms

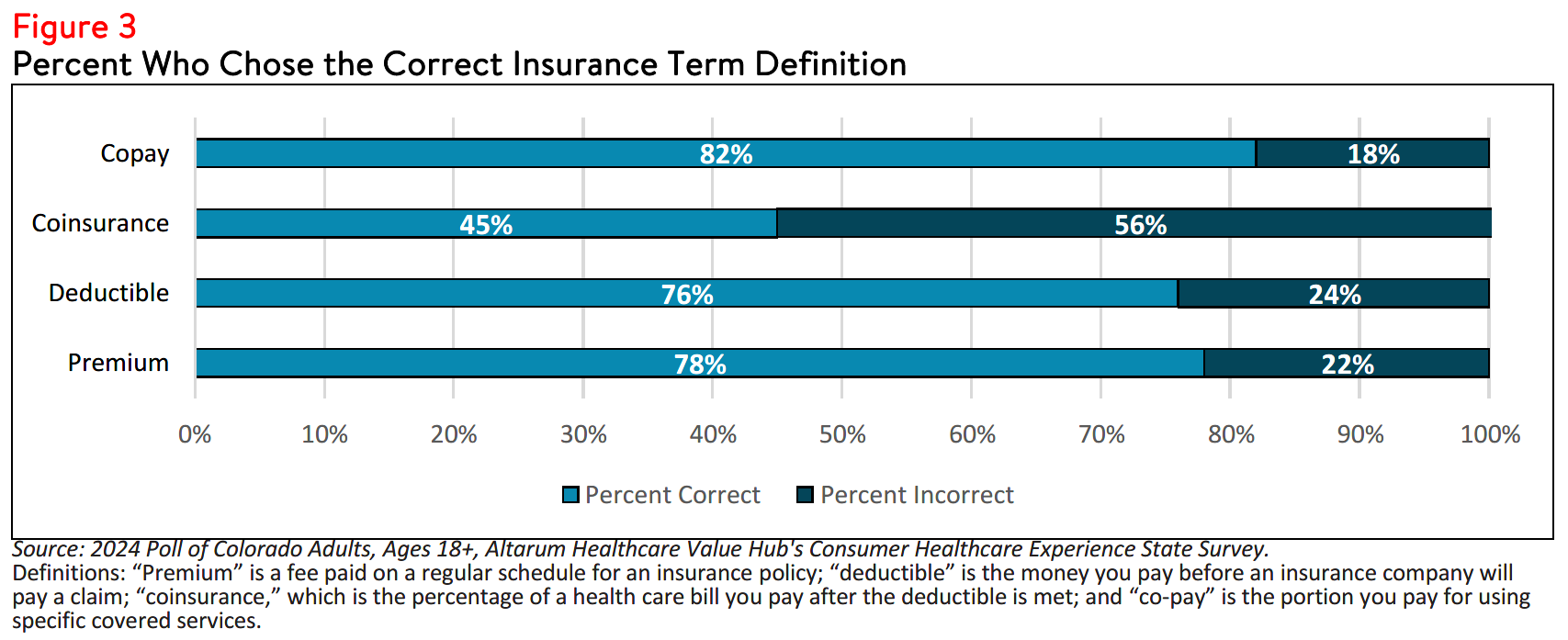

Research indicates that nearly half of insured adults find at least one aspect of their insurance difficult to

understand, highlighting the need for efforts to simplify health insurance coverage and provide

predictable out-of-pocket price structures.7 When given multiple choices, three out of four (78% of)

Colorado respondents were able to correctly define “premium” and a similar amount (76%) were able to

correctly define “deductible”, while fewer than half (45%) were able to accurately define “coinsurance”

(see Figure 3).

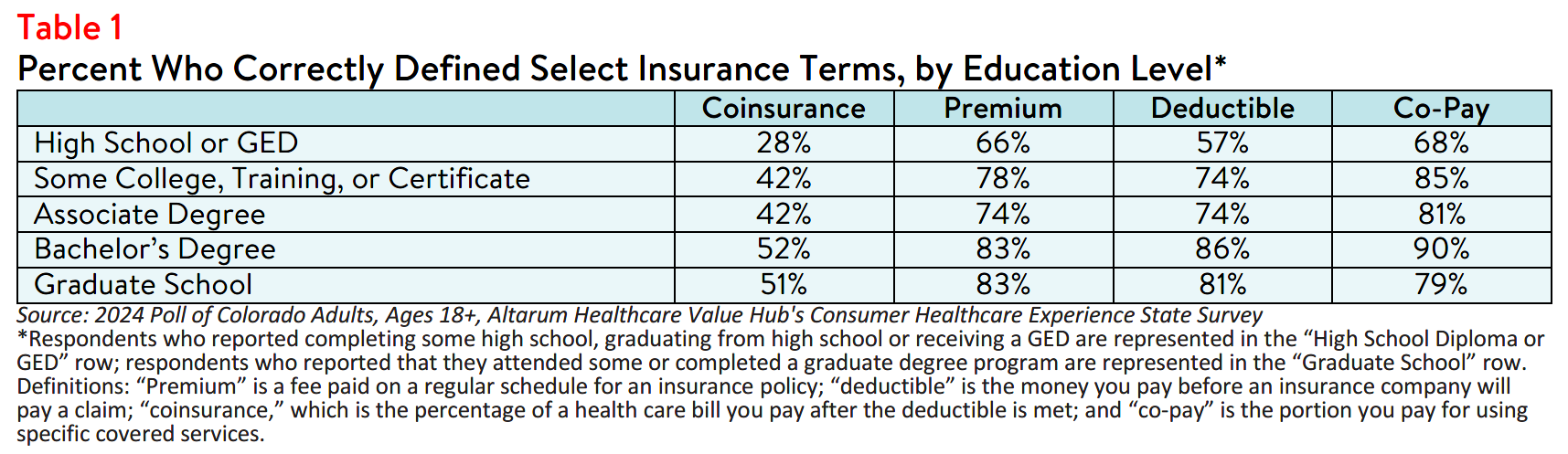

Increased consumer education surrounding health insurance literacy may provide some relief, illustrated

by the fact that more educated respondents generally performed better when asked to define these

terms (see Table 1). However, consumer education does not fully address the underlying factors.

Comprehensive solutions should include outreach in addition to efforts to simplify the system.8

A state that manages their own state-based health insurance Marketplace may see a greater impact from

providing simplified options, decision aids, and consumer-focused health insurance product design.9

Unexpected Medical Bills

Twenty-four percent of Colorado respondents received a surprise medical bill in the past year. Among

those, respondents who purchase their own insurance (e.g., through the health care Marketplace) most

frequently reported receiving a surprise medical bill (34%), followed by respondents with employer-

sponsored health insurance (28%); respondents enrolled in Health First Colorado, the state Medicaid

program (18%); and those enrolled in Medicare coverage (18%).

When asked about the nature of their surprise medical bill, half (50%) of respondents reported that the

amount was higher than anticipated, and 32% reported that the bill was from a provider that they didn’t

expect to receive a bill from. In smaller numbers, 20% reported being charged out-of-network rates by a

provider they believed was in-network, 10% reported being charged for services they did not receive and

24% reported experiencing something else unexpected.

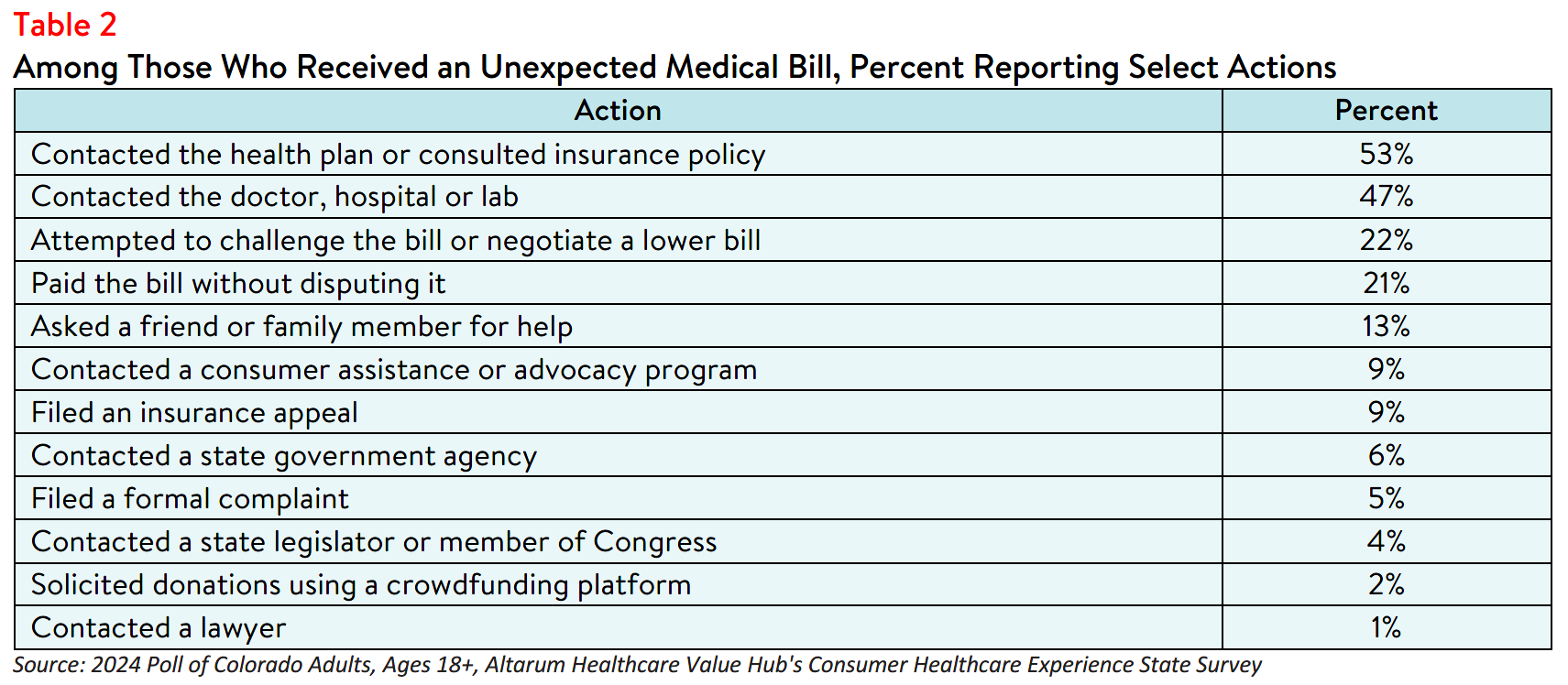

Beyond describing the nature of and/or reason the bill was unexpected, respondents also reported various attempts to resolve the issue. Of those who received an unexpected medical bill in the past year, more than half (52%) took more than one step in their attempt to resolve their unexpected medical. Many

contacted their health plan (53%) or provider (47%), some paid the bill without disputing it (21%), and few

(9%) filed an insurance appeal (see Table 2).

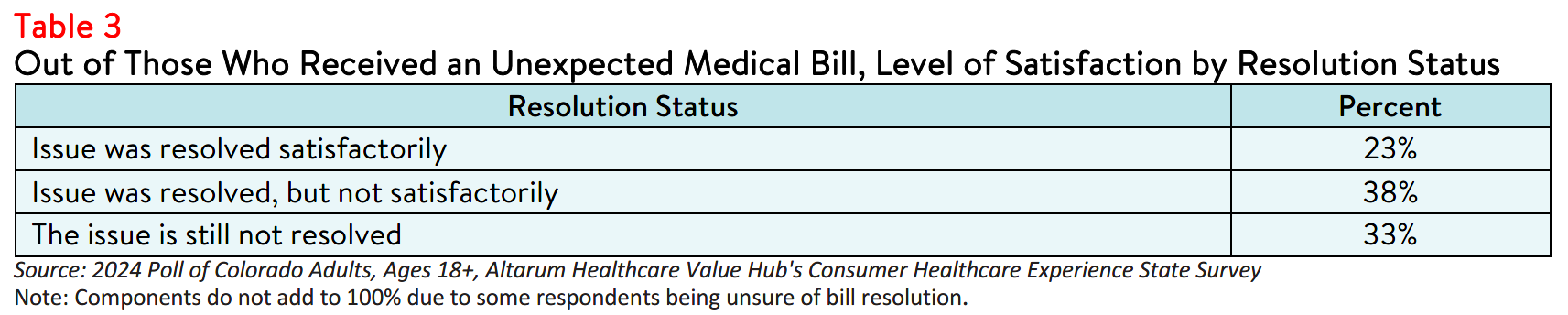

Only 23% of respondents with an unexpected medical bill indicated that the issue was resolved to their

satisfaction (see Table 3). Notably, satisfied respondents often reported employing more direct resolution

strategies, such as contacting their health plan, whereas respondents who reported being dissatisfied with

the resolution were more likely to have paid the original bill without disputing.

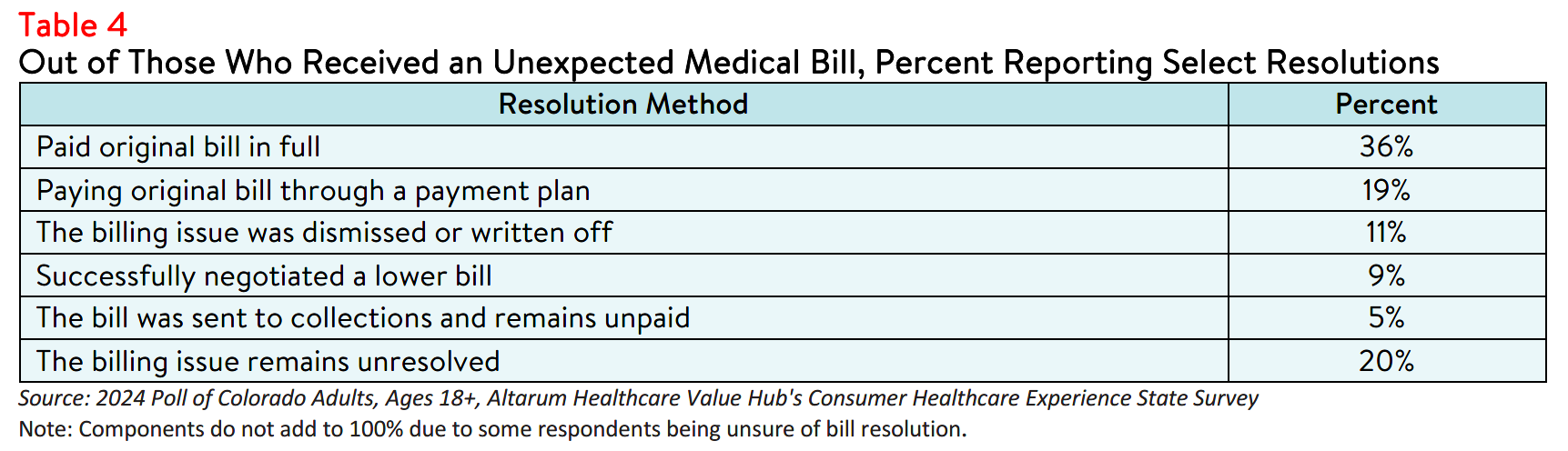

Regardless, the majority of respondents reported that they settled their bills by paying in full (36%) or

through a payment plan (19%), while a smaller number successfully negotiated a lower bill (9%) or had their bill dismissed (11%) (see Table 4). In a small number of cases, (<1%) respondents reported filing for

bankruptcy due to an unexpected medical bill. Some respondents (14%) also reported being contacted by

a collection agency, underscoring the need to address the cost of health care across the state.10

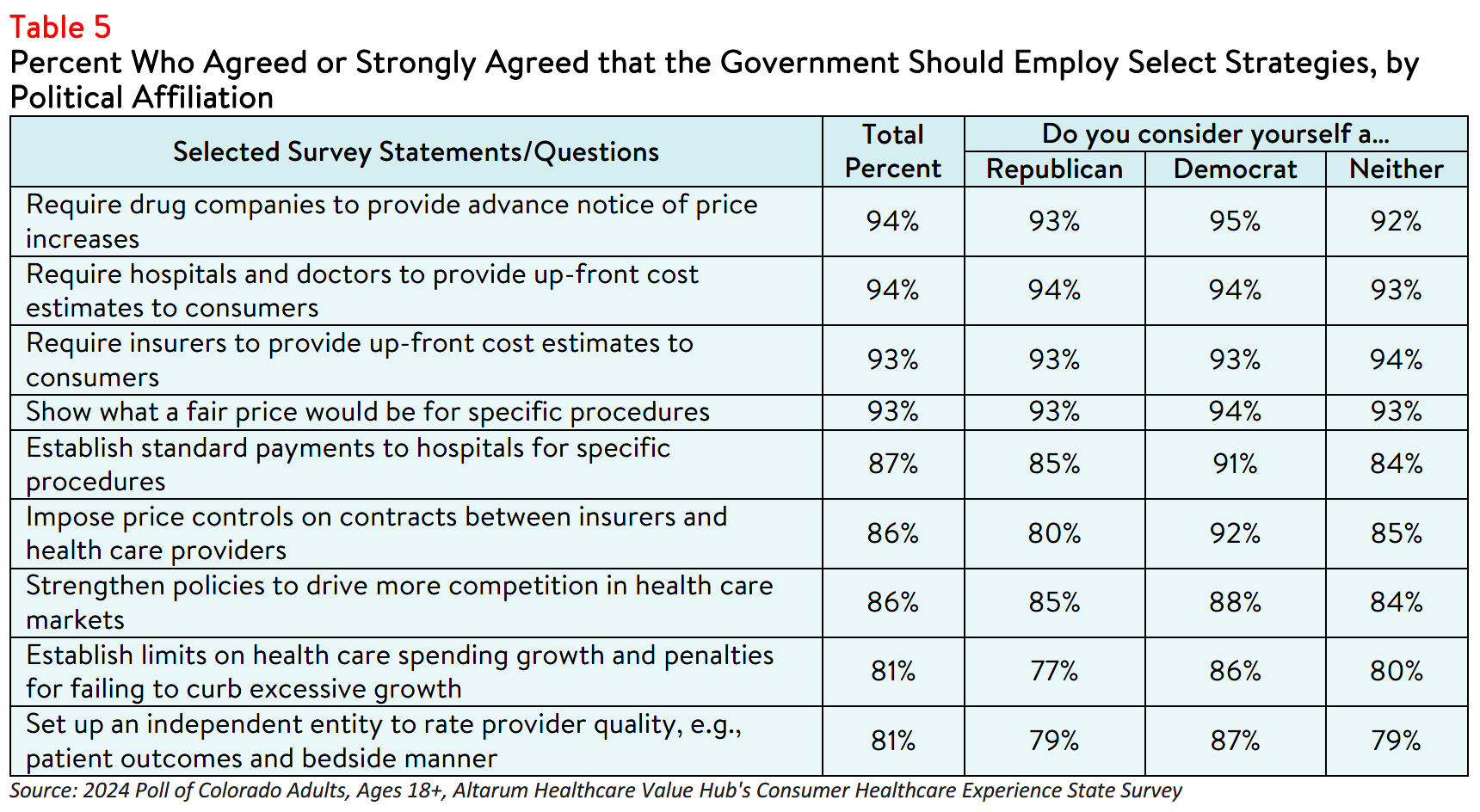

Support for Solutions Across Party Lines

The burden of health care costs and the widespread support for reform indicate that elected leaders and

other stakeholders must prioritize addressing these consumer challenges. Colorado respondents

overwhelmingly endorsed several transparency-oriented strategies, including:

- 94% — Require drug companies to provide advanced notice of price increases;

- 94% — Require hospitals and doctors to provide up-front cost estimates to consumers;

- 93% — Require insurers to provide up-front cost estimates to consumers;

- 93% — Show what a fair price would be for specific procedures;

- 87% — Establish standard payments to hospitals for specific procedures;

- 86% — Impose price controls on contracts between insurers and health care providers;

- 86% — Strengthen policies to drive more competition in health care markets;

- 81% — Establish limits on health care spending growth; and

- 81% — Set up an independent entity to rate doctor and hospital quality, such as patient outcomes and bedside manner.

Support for these solutions extended across the aisle, reflecting bipartisan agreement on the need for

greater health care price transparency and policies designed to reduce the frequency of surprise medical

bills (see Table 5). It must be noted that, although price transparency tools can help identify unwarranted

price variation, these tools alone do not make markets more efficient and generally fail to encourage

consumers to shop for lower-priced services.11 Instead, policymakers should consider a combination of

transparency tools and evidence-based policies to effectively address these issues.

Conclusion

While Colorado respondents report confidence in following their doctor's directions or filling

prescriptions, they are less confident in handling cost issues and resolving problems with providers, health plans, and hospitals. These difficulties may contribute to unexpected medical bills, increased affordability burdens, and challenges in resolving bills satisfactorily. State legislators and advocates should consider a variety of interventions, including efforts to redesign health insurance products with the consumer experience in mind, to improve access to comprehensive health care cost and quality information.

Notes

- A person's ability to seek, obtain, and understand health insurance plans, and once enrolled, use their insurance to seek appropriatehealth care services.

- A person’s ability to obtain, process, and understand basic health information and services needed to manage one’s health and make appropriate health decisions.

- Shahid, R., Shoker, M., Chu, L.M. et al. Impact of low health literacy on patients’ health outcomes: a multicenter cohort study. BMC Health Serv Res 22, 1148 (2022). https://doi.org/10.1186/s12913-022-08527-9

- According to Health Forum, an affiliate of the American Hospital Association, hospital adjusted expenses per inpatient day in Colorado were $3,567 in 2022. See: Kaiser Family Foundation, State Health Facts Data: Hospital Adjusted Expenses per Inpatient Day, (Accessed Sept. 27, 2024).

- As of January 1, 2021, the Centers for Medicare and Medicaid Services (CMS) requires hospitals to make public a machine-readable file containing a list of standard charges for all items and services provided by the hospital, as well as a consumer-friendly display of at least 300 shoppable services that a patient can schedule in advance. However, Compliance from hospitals has been mixed, indicating that the rule has yet to demonstrate the desired effect. https://www.healthaffairs.org/content/forefront/hospital-price-transparency-progress-and-commitment-achieving-its-potential "What Do We Know About Prices and Hospital Quality?", Health Affairs Blog, July 29, 2019.

https://www.healthaffairs.org/content/forefront/do-we-know-prices-and-hospital-quality (Accessed September 26, 2023). - Pollitz, K., Pestaina, K., Montero, A., Lopes, L., Valdes, I., Kirzinger, A., Brodie, M., KFF Survey of Consumer Experiences with Health Insurance, (KFF, June 15, 2024) https://www.kff.org/report-section/kff-survey-of-consumer-experiences-with-health-insurance-methodology/ (Accessed September 26, 2023).

- Edward, J., Wiggins, A., Young, M. H., & Rayens, M. K. (2019). Significant Disparities Exist in Consumer Health Insurance Literacy: Implications for Health Care Reform. Health literacy research and practice, 3(4), e250–e258. https://doi.org/10.3928/24748307-20190923-01

- Barcellos, S. H., Wuppermann, A., Carman, K. G., Bauhoff, S., McFadden, D., Kapteyn, A., Winter, J., & Goldman, D. P. (2014). Preparedness of Americans for the affordable care act. Proceedings of the National Academy of Sciences, 111(15), 5497-5502. https://doi.org/10.1073/pnas.1320488111

- For more survey data on collections and medical debt, see: Colorado Respondents Struggle to Afford High Healthcare Costs; Express Across Party Lines Support for a Range of Government Solutions, Healthcare Value Hub, August 2024 10. Benavidez G, Frakt A. Price Transparency in Health Care Has Been Disappointing, but It Doesn’t Have to Be. JAMA. 2019;322(13):1243–1244. https://jamanetwork.com/journals/jama/fullarticle/2752049 (Accessed on September 26, 2024).

- Benavidez G, Frakt A. Price Transparency in Health Care Has Been Disappointing, but It Doesn’t Have to Be. JAMA. 2019;322(13):1243–1244. https://jamanetwork.com/journals/jama/fullarticle/2752049 (Accessed on September 26, 2024).

Methodology

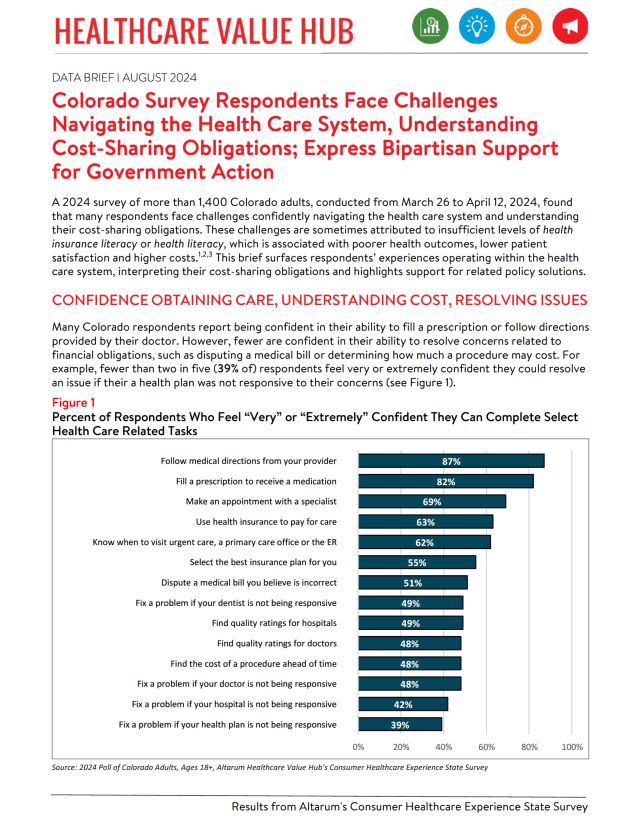

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ views on a wide range of health system issues, including confidence using the health system, financial burden and possible policy solutions. This survey, conducted from March 26 to April 12, 2024, used a web panel from Dynata with a demographically balanced sample of approximately 1,500 respondents who live in Colorado. Information about Dynata’s recruitment and compensation methods can be found here. The survey was conducted in English or Spanish and restricted to adults ages 18 and older. Respondents who

finished the survey in less than half the median time were excluded from the final sample, leaving 1,412 cases for analysis. After those exclusions, the demographic composition of respondents was as follows, although not all demographic information has complete response rates: