Colorado Survey Respondents Struggle to Afford High Health Care Costs; Worry about Affording Health Care in the Future; Support Government Action Across Party Lines

Key Findings

A survey of more than 1,400 Colorado adults, conducted from March 26 to April 12, 2024, found that:

- Nearly 3 in 4 (70%) experienced at least one health care affordability burden in the past year;

- Over 4 in 5 (83%) worry about affording health care in the future;

- Over 2 in 3 (68%) of all respondents delayed or went without health care due to cost in the last twelve months;

- Low-income respondents and those with disabilities had higher rates of going without care due to cost and incurring medical debt, depleting savings, and/or sacrificing basic needs due to medical bills; and

- Across party lines, respondents express strong support for government-led solutions.

A Range of Health Care Affordability Burdens

Like many Americans, Colorado adults experience hardship due to high health care costs. In the past

twelve months, seven out of ten (70%) respondents experienced at least one of the following health care

affordability burdens:

1) Being Uninsured Due to High Costs

Greater than two in five (44%) uninsured respondents cited cost (“too expensive”) as the primary reason

for being uninsured, surpassing other potential responses such as “don’t need it” and “don’t know how to

get it.” Likewise, 44% of respondents without dental insurance and 33% of those without vision insurance

cited cost as the main reason for not having coverage.

2) Delaying or Going Without Health Care Due to Cost

Well over half (68%) of all respondents reported delaying or going without health care during the prior 12

months due to cost:

- 30%—Delayed going to the doctor or having a procedure done

- 29%—Skipped needed dental care

- 26%—Cut pills in half, skipped doses of medicine or did not fill a prescription1

- 25%—Skipped a recommended medical test or treatment

- 21%—Had problems getting mental health care or addiction treatment2

- 20%—Avoided going to the doctor or having a procedure done altogether

- 17%—Skipped needed vision services

- 8%—Skipped needed hearing services

- 6%—Skipped or delayed getting a medical assistive device

Moreover, respondents most frequently cited cost as the reason for them or their family members not

getting care in the last year (24%) followed by not being able to get an appointment (19%), exceeding a

host of other barriers like getting time off work, transportation, and lack of childcare.

3) Struggling to Pay Medical Bills

Other times, respondents got the care they needed but experienced a cost burden due to the resulting

medical bill(s). Over one-third (37%) of respondents reported experiencing one or more of these

struggles to pay their medical bills:

- 18%—Used up all or most of their savings

- 13%—Were contacted by a collection agency

- 12%—Were unable to pay for basic necessities like food, heat or housing

- 12%—Racked up large amounts of credit card debt

- 9%—Borrowed money, got a loan or another mortgage on their home

- 9%—Were placed on a long-term payment plan

- 4% - Asked for donations (GoFundMe campaigns)

High Levels of Worry About Affording Health Care in the Future

Colorado respondents also exhibit high levels of worry about affording health care in the future. Over

four in five (83%) reported being “worried” or “very worried” about affording some aspect of health care

in the future, including:

- 66%—Cost of nursing home or home care services

- 66%—Health insurance will become unaffordable

- 65%—Medical costs when elderly

- 63%—Medical costs in the event of a serious illness or accident

- 51%—Prescription drugs will become unaffordable

- 51%—Cost of dental care

- 46%—Cost of needed vision services

- 43%—Cost of needed hearing services

While two of the most common worries—affording the cost of nursing home or home care services and

medical costs when elderly—are applicable predominantly to an older population, they were most

frequently reported by younger respondents. Respondents aged 25-34 reported the highest worry about

medical costs in old age, and those aged 25-54 were most concerned about affording nursing home or

home care costs. This suggests that Colorado respondents may be worried about affording the cost of

care for both aging relatives and themselves.

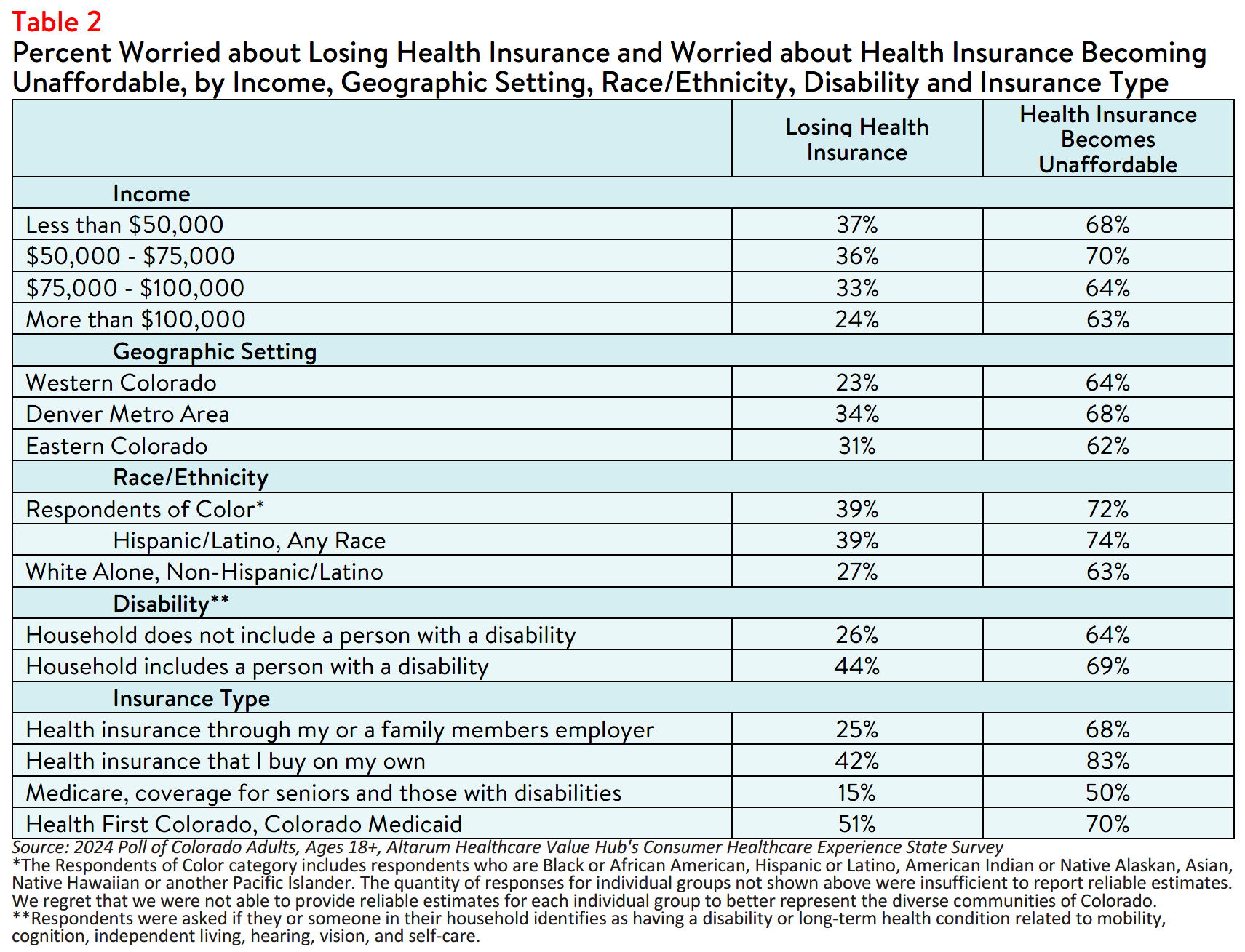

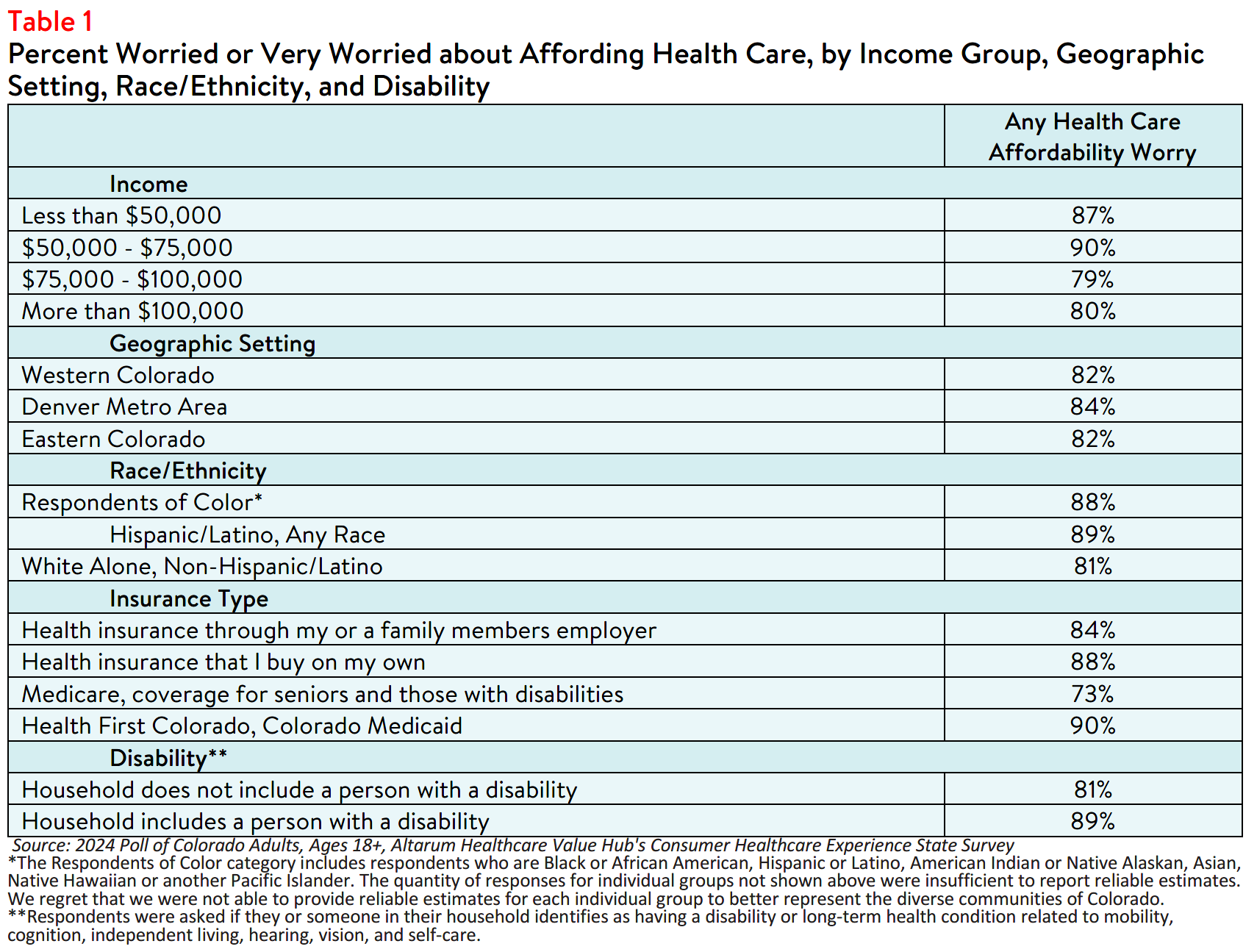

Additionally, worry about affording health care was highest among respondents living in low-income

households, those with a disabled household member, and those in the Denver Metro area (see Table 1).

Overall, 90% of respondents with an annual household income between $50,000 and $75,000 reported

worrying about affording some aspect of coverage or care in the past year. However, 80% of those

earning over $100,000 per year also reported concerns.3 In fact, concerns were consistent across all

respondent income levels, education levels, races, ethnicities, geographic settings, and abilities.

Similarly, respondents with Medicaid most frequently reported being worried about affording health care,

followed closely by respondents with health insurance they purchased on their own, such as coverage

through the health insurance Marketplace (see Table 1). Although Health First Colorado, the state

Medicaid program, offers coverage for a variety of physical, dental and behavioral health services, this

data point may indicate that Medicaid enrollees have faced financial barriers to receiving services not

covered by the plan.

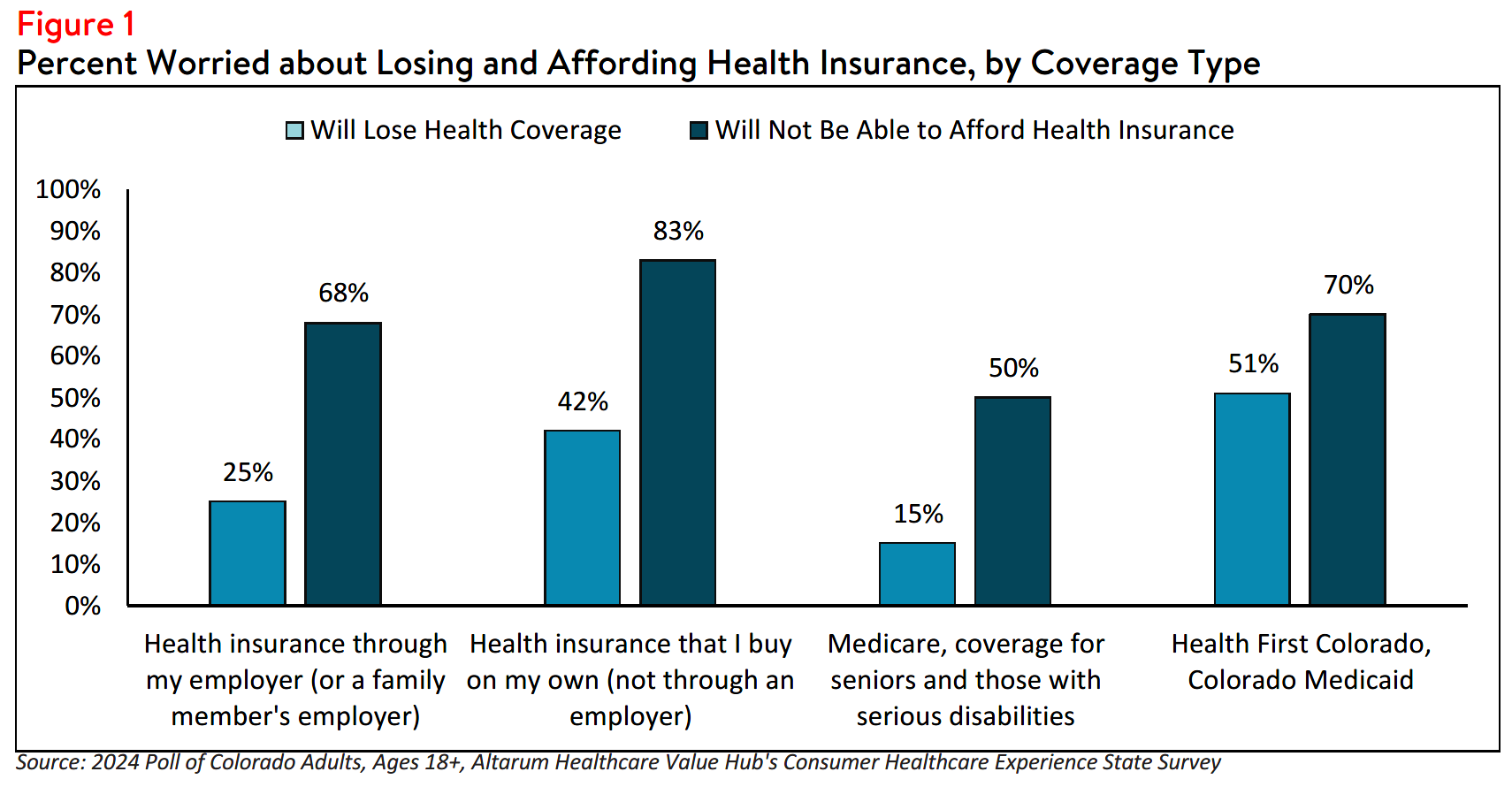

Respondents reported being worried about insurance becoming unaffordable more frequently than being

worried about losing coverage across all income levels, regions, races/ethnicities, and coverage types.

Concerns that health insurance would become unaffordable was most prevalent among those with

insurance they purchased on their own, such as through the Health Insurance Marketplace (see Figure 1).

Similarly, respondents with an annual household income between $50,000 and $75,000 reported the

highest rates of concern that health insurance will become too expensive to maintain coverage, followed

by respondents with an annual household income below $50,000. Likewise, respondents living in the

Denver metro area and respondents living in a household that includes a person with a disability also

reported the highest rates of concern that health insurance will become unaffordable (see Figure 1).

Although concerns about affording coverage surpassed fears about losing coverage, the data indicates that certain respondents are more concerned about losing coverage than others. Concerns about losing health insurance coverage were most prevalent among those with an annual household income below $50,000 as well as among households with a person with a disability, and respondents living in the Denver metro area (see Table 2).

Differences in Health Care Affordability Burdens

The survey also revealed differences in how Colorado respondents experience health care affordability

burdens by income, age, geographic setting, disability, race and ethnicity.

Income and Age

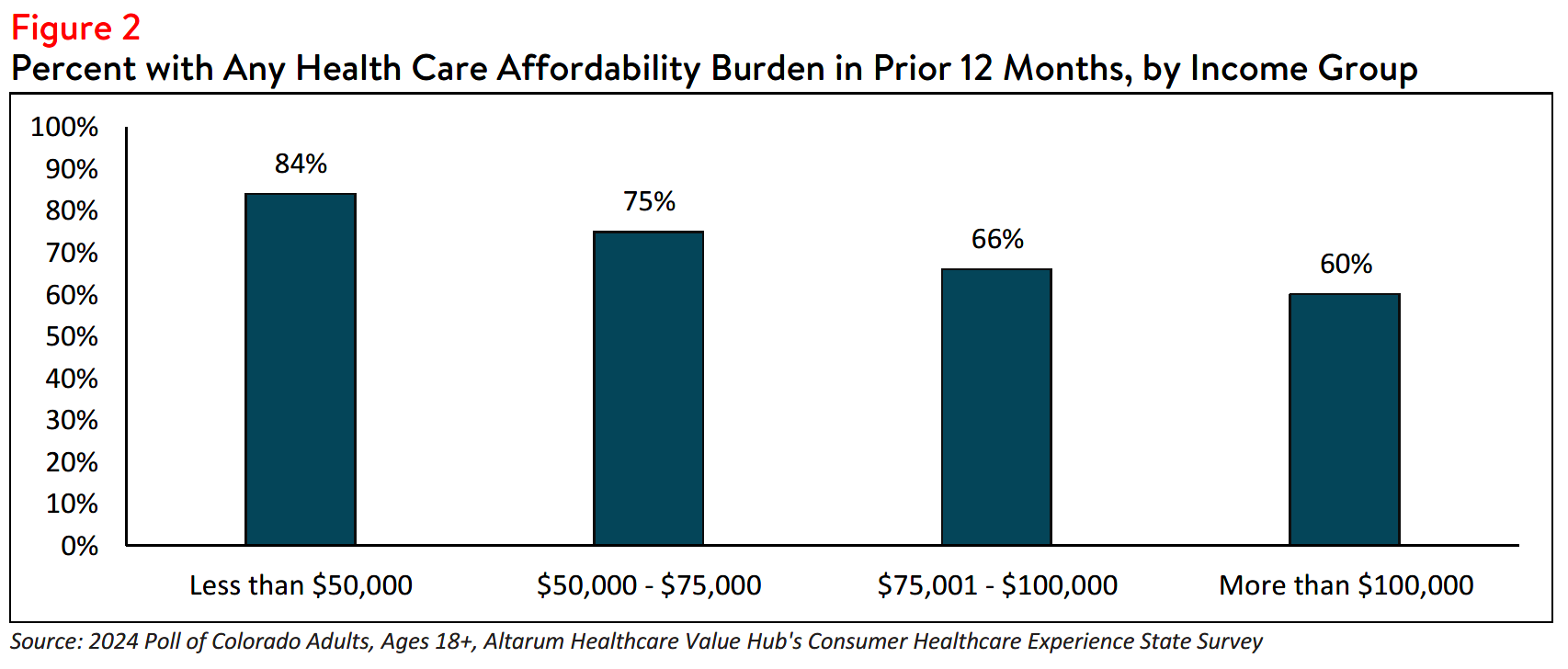

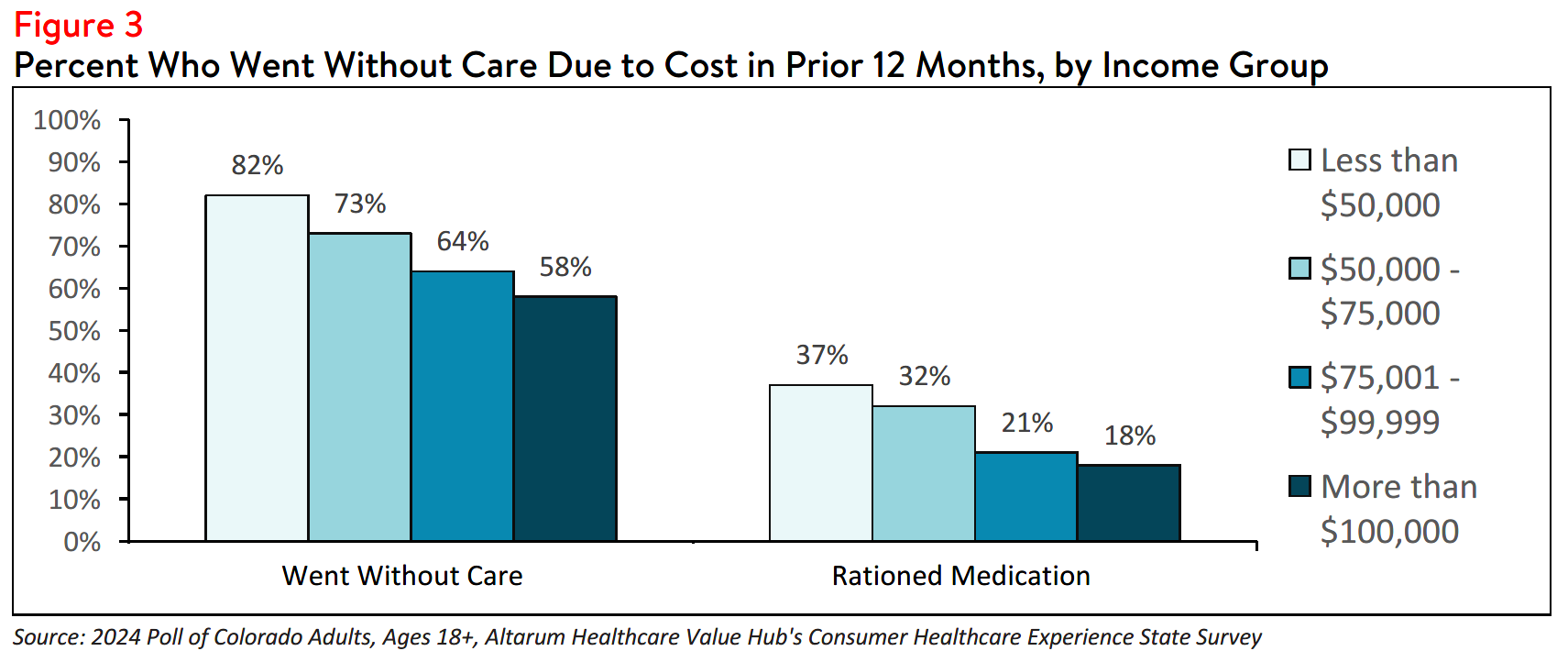

Respondents at the lowest end of the income spectrum most frequently reported experiencing one or more health care affordability burdens. Greater than four out of five (84%) respondents earning less than

$50,000 per year reported struggling to afford some aspect of coverage or care in the past 12 months (see Figure 2). This may be related, in part, to respondents in this income group reporting higher rates of going without care and rationing their medication due to cost (see Figure 3).

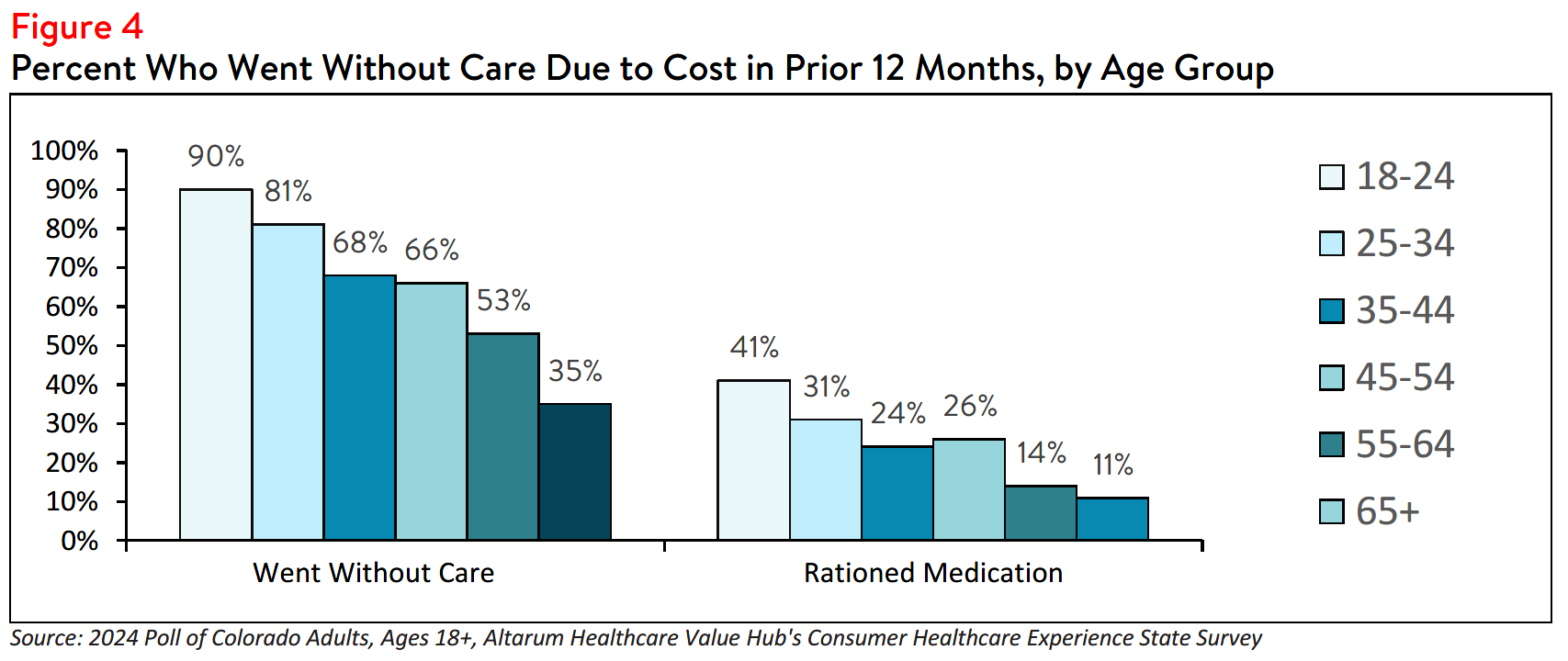

Further analysis found that Colorado respondents aged 18-24 reported the highest rates of forgoing care

due to cost. However, at least half of respondents aged 18-64 reported going without care due to

financial barriers, signaling that the issue extends across age groups. Likewise, respondents aged 18-44

most frequently reported rationing medication due to cost compared to other age groups (see Figure 4).

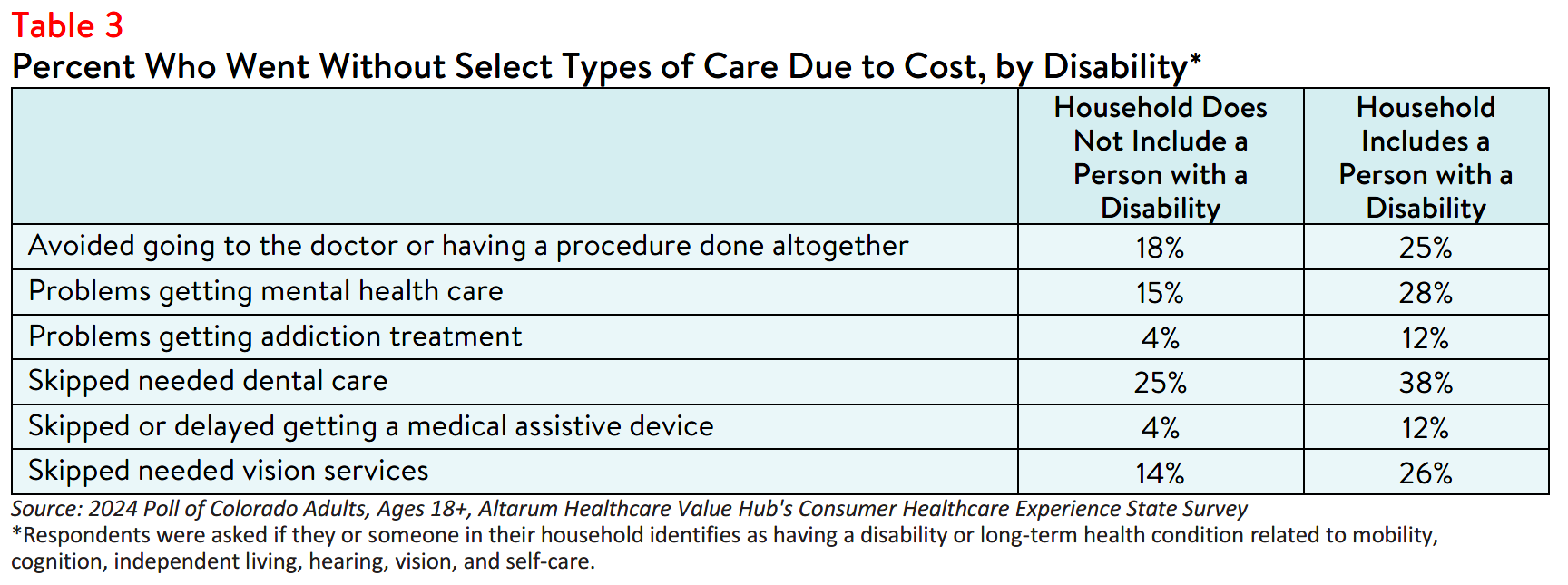

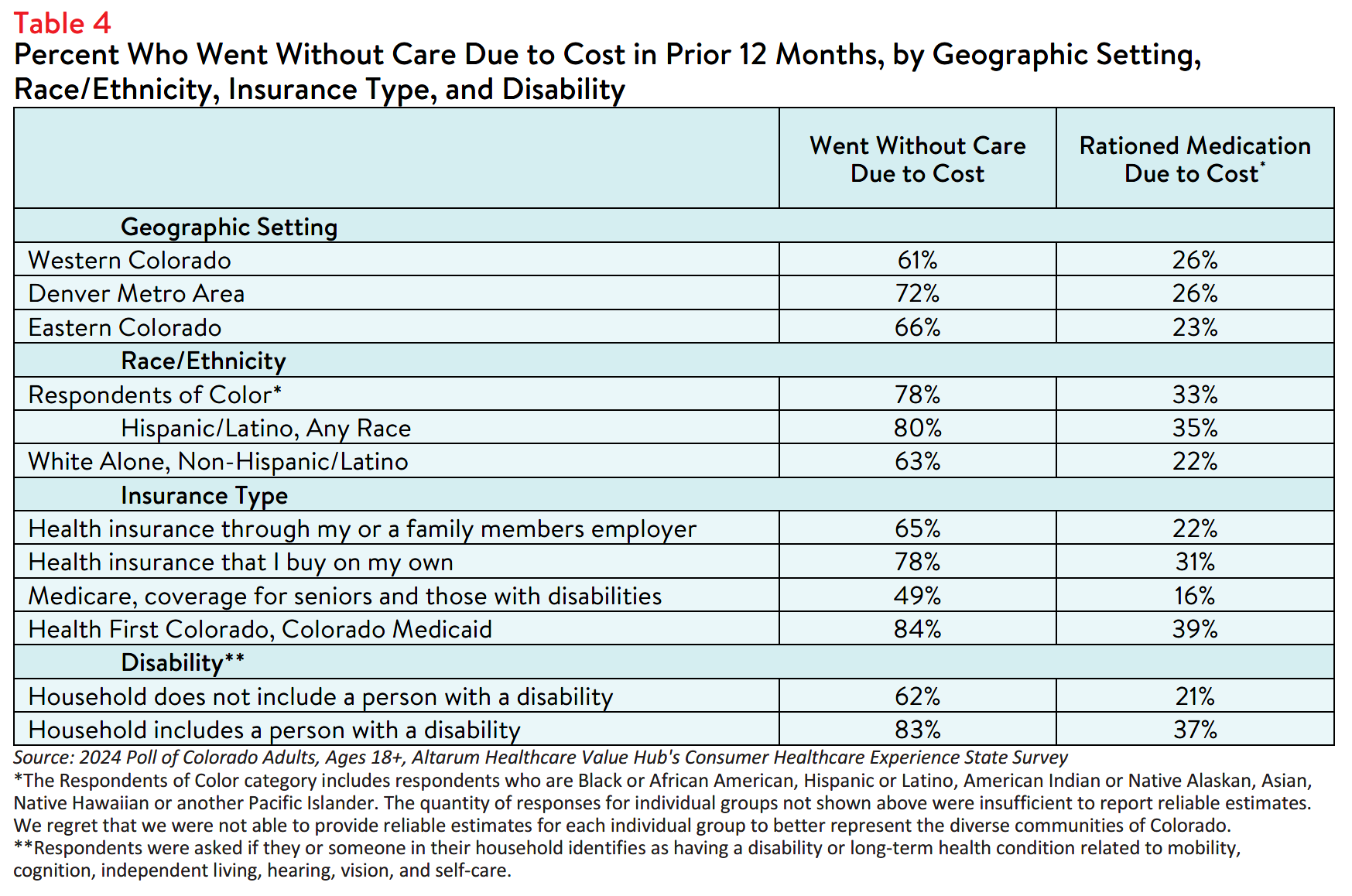

Disability

Respondents living in households with a person with a disability reported the highest rates forgoing care

and rationing medication due to cost. Of those included in this group, 83% reported going without some

form of care and 37% reported rationing medication due to cost in the past year. In contrast, fewer

respondents living in a household without a person with a disability reported forgoing care (62%) and

rationing medication (21%) due to cost (see Table 4).

Additionally, respondents living in households with a person with a disability more frequently reported

skipping necessary mental health, addiction treatment, vision and dental care services due to cost

compared to respondents living in households without a person with a disability (see Table 3).

Those with disabilities also face health care affordability burdens unique to their disabilities— 12% of

respondents with a disabled household member reported delaying getting a medical assistive device such

as a wheelchair, cane/walker, hearing aid, or prosthetic limb due to cost. Only 4% of respondents in

households without a disabled person reported this experience.

Insurance Type

People with different types of insurance navigate the health care system in varying ways. Those with

private insurance may face higher premiums and out-of-pocket costs, while individuals enrolled in

Medicaid or Medicare generally have lower costs but may encounter limited provider options, greater

restrictions around covered services, and longer wait times for services.

In Colorado, respondents enrolled in Medicaid reported the highest rates of going without care due to

cost and rationing medication, followed by respondents with private insurance purchased independently

(see Table 4). Still, nearly half (49%) of respondents with Medicare coverage also went without care due

to cost in the twelve months prior to taking the survey.

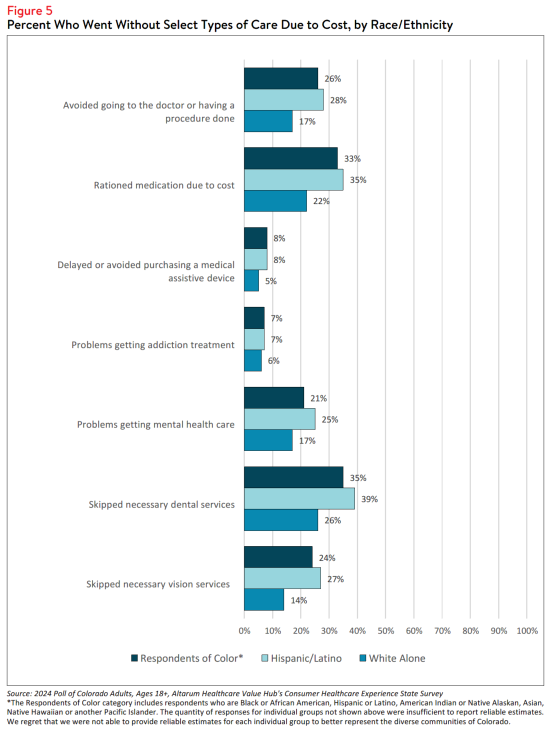

Race and Ethnicity

Respondents of color reported going without care due to cost more frequently than white respondents.

Similarly, these respondents also reported rationing medication due to financial concerns at higher rates

than white respondents. There are a variety of potential consequences related to postponing health care

and medication rationing, highlighting the importance of addressing cost-related barriers to address

health disparities.

In Colorado, eighty percent (80%) of Hispanic/Latino respondents reported going without care due to

cost in the past twelve months compared to 63% of white alone, non-Hispanic/Latino respondent (see

Table 4). Further analysis showed that respondents of color also reported higher rates of skipping dental

services, vision services, and recommended medical tests or treatments (see Figure 5).

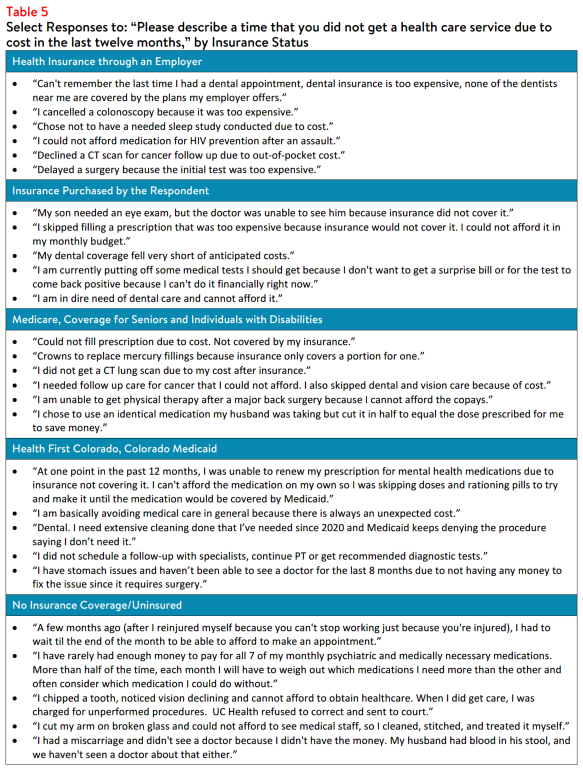

In an effort to explore the impact high health costs have on individuals, respondents were also asked to

describe a time that they were unable to get health care due to cost (see Table 5). These anecdotes

highlight affordability challenges, underscore the impact of health care costs on individuals, and

emphasize the need for solutions to reduce financial barriers to care.

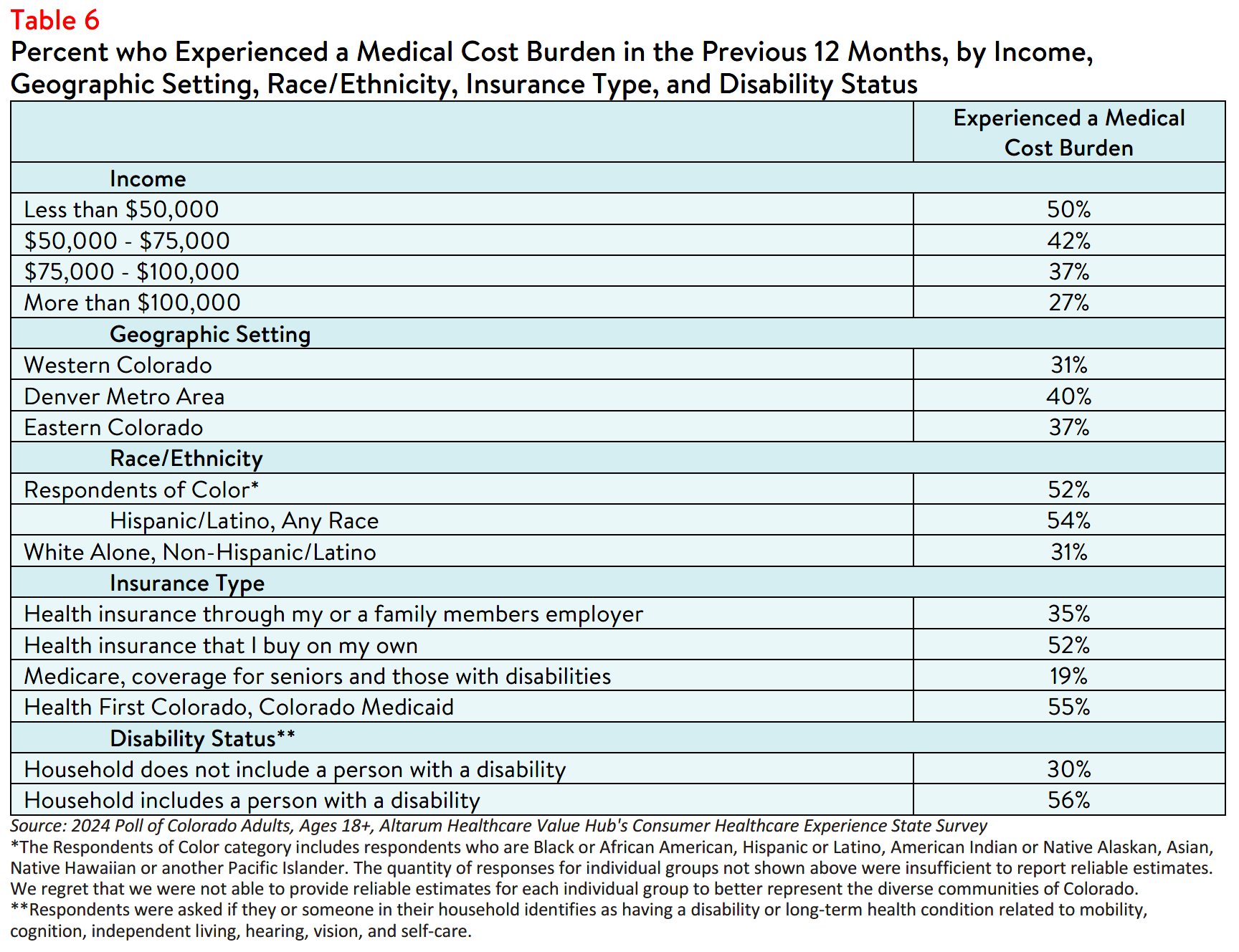

Encountering Medical Debt

In the absence of affordable care options, individuals may find themselves burdened by medical costs. To

explore the impact of unaffordable medical care, survey participants were asked whether they have had to

do any of the following due to the cost of medical bills in the past twelve months: use up all or most of

their savings; sacrifice basic necessities, such as food, heat, or housing; borrow money, get a loan or take

out another mortgage; use a crowdfunding platform to solicit donations; interact with a collections

agency; go into credit card debt; be placed on a long-term payment plan; or declare bankruptcy.

The survey results revealed that respondents of color reported at least one of the previous experiences

more frequently than white respondents. Likewise, respondents who have or live with a person with a

disability also reported navigating medical cost burdens more frequently than respondents without a

disabled household member, and respondents with Medicaid coverage reported the highest rates of the

above burdens due to medical bills (55%) compared to respondents with all other insurance types (see

Table 6).

Impact of and Worry Related to Hospital Consolidation*

In addition to the above healthcare affordability burdens, a small share of Colorado respondents reported

being negatively impacted by health system consolidation. Between 2018 to 2023, there have been 4

changes in ownership involving hospitals through mergers, acquisitions, or CHOW in Colorado.4,5

Colorado requires that the State Attorney General be notified of all hospital transactions but does not

grant the authority to approve or deny transactions.6 However, the state does require that nonprofit

hospitals must provide annual reports indicating that the change in ownership has not negatively impacted

access to health services in the affected communities for five years following the transaction.

In the past year, 32% of respondents reported that they were aware of a merger or acquisition in their

community—of those respondents, 19% reported that they or a family member were unable to access

their preferred health care organization because of a merger that made their preferred organization out-

of-network. Out of those who reported being unable to access their preferred healthcare provider due to

a merger:

- 43% — delayed or avoided going to the doctor or having a procedure done because they could no longer access their preferred health care organization due to a merger,

- 37% — skipped recommended follow-up visits due to a merger,

- 36% — changed their preferred doctor or hospital to one that is in-network, and

- 19% — had to change their preferred provider due to a merger resulting in a service closure.

Out of those who reported that the merger caused an additional burden for them or their families, the top

three most frequently reported issues were:

- 30% — The merger created an added financial burden

- 27% — The merger created a gap in the continuity of my care

- 26% — The merger created an added wait time when searching for a new provider

While a smaller portion of respondents reported being unable to access their preferred health care

organization because of a merger, far more respondents (57%) reported being somewhat, moderately or

very worried about the impacts of mergers in their health care organizations. When asked about their

largest concern respondents most frequently reported:

- 29% — I’m concerned I will have fewer choices of where to receive care

- 26% — I’m concerned I will have to pay more to see my doctor

- 25% — I’m concerned my doctor may no longer be covered by my insurance

- 10% — I’m concerned I will have a lower quality of care

- 9% — I’m concerned I will have to travel farther to see my doctor

Dissatisfaction with the Health System and Support for Change

In light of Colorado respondents’ health care affordability burdens and concerns, it is unsurprising that

many reported being dissatisfied with the health care system. In fact, three in four (76% of) respondents

agreed or strongly agreed that they believe the health care system needs to change. Moreover, only 27%

of respondents agreed or strongly agreed that they believe we have a great healthcare system in the

United States. To investigate further, the survey asked respondents to share their perspectives on both

personal and governmental actions to address the high health costs.

Personal Actions

Colorado respondents see a role for themselves in addressing health care affordability. When asked about specific actions they could take:

- 55% of respondents reported researching the cost of a drug beforehand, and

- 81% said they would be willing to switch from a brand name to an equivalent generic drug if given the chance.

When asked to select the top three personal actions respondents believe would be the most effective to

improve health care affordability (out of ten possible options), the most common responses were:

- 68% — Take better care of my personal health

- 40% — Research treatments myself before going to the doctor

- 35% — Do more to compare provider cost and quality before getting services

- 23% — Contact my state representatives asking them to address high healthcare prices and lack of affordable coverage options

- 28% — There is nothing I can do personally to make our health system better

Government Actions

Colorado respondents see government as the key stakeholder that needs to act to address health system

problems. Moreover, addressing health care problems is one of the top priorities that respondents want

their elected officials to work on. At the beginning of the survey, respondents were asked what issues the

government should address in the upcoming year. Respondents most frequently chose:

- 45% — Affordable Housing

- 43% — Economy/Joblessness

- 41% — Health care

When asked about the top three health care priorities the government should address, respondents most

frequently chose:

- 56% — Address high health care costs, including prescription drugs

- 33% — Preserve consumer protections preventing people from being denied coverage or charged more for having a pre-existing medical condition

- 27% — Get health insurance to those who cannot afford coverage

- 27% — Improve Medicare, coverage for seniors and those with serious disabilities

Out of fifteen possible options, Colorado respondents most frequently reported believing that the reason

for high health care costs is unfair prices charged by powerful industry stakeholders, such as:

- 79% — Drug companies charging too much money

- 71% — Hospitals charging too much money

- 71% — Insurance companies charging too much money

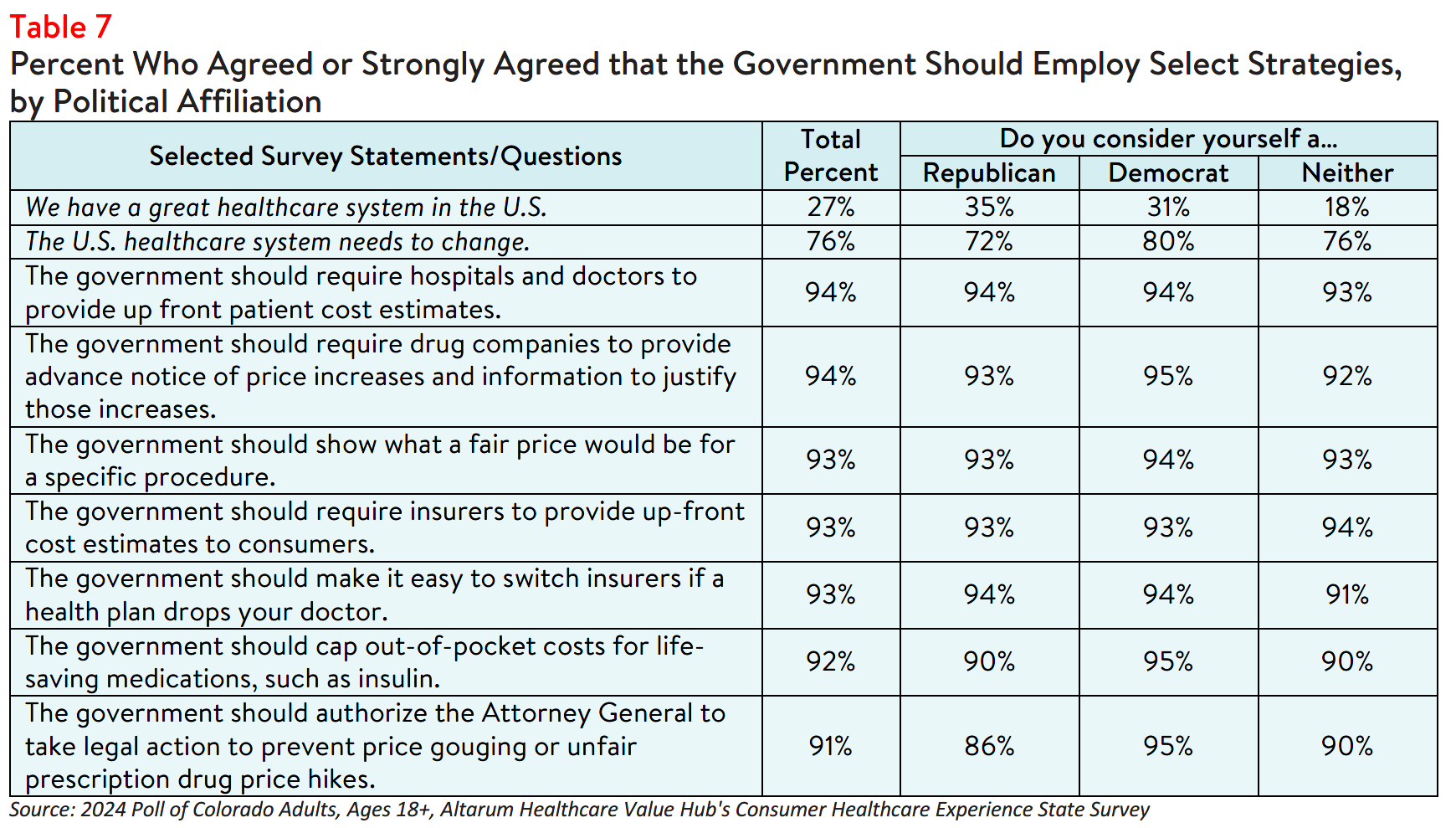

When it comes to tackling costs, respondents endorsed a number of strategies, including:

- 94% — Require hospitals and doctors to provide up-front cost estimates to consumers

- 93% — Show what a fair price would be for specific procedures

- 93% — Require insurers to provide up-front cost estimates to consumers

- 93% — Make it easy to switch insurers if a health plan drops your doctor

- 92% — Cap out-of-pocket costs for life-saving medications, such as insulin

- 91% — Set standard prices for drugs to make them affordable

- 91% — Authorize the Attorney General to take legal action to prevent price gouging or unfair prescription drug price hikes

Support for Action Across Party Lines

There is support for change regardless of respondents' political affiliation (see Table 7). The high burden of health care affordability, along with high levels of support for change, suggest that elected leaders and

other stakeholders need to make addressing this consumer burden a top priority. Annual surveys can help

assess whether progress is being made.

Notes

- Of the 70% of respondents who encountered one or more cost-related barriers to getting health care during the past twelve months, 20% did not fill a prescription and 11% cut pills in half or skipped doses of medicine due to cost.

- Eighteen percent (18%) had problems getting mental health care and 6% had problems getting addiction treatment.

- Median household income in Colorado is $87,598 (2018-2022). U.S. Census, Quick Facts. Retrieved from: U.S. Census Bureau QuickFacts, U.S. Census Bureau QuickFacts: Colorado.

- Centers for Medicare and Medicaid Services. (2023). Hospital Change of Ownership. Retrieved June 5, 2024, from https://data.cms.gov/provider-characteristics/hospitals-and-other-facilities/hospital-change-of-ownership.

- A CHOW typically occurs when a Medicare provider has been purchased (or leased) by another organization. The CHOW results in the transfer of the old owner's identification number and provider agreement (including any Medicare outstanding debt of the old owner) to the new owner…An acquisition/merger occurs when a currently enrolled Medicare provider is purchasing or has been purchased by another enrolled provider. Only the purchaser's CMS Certification Number (CCN) and tax identification number remain. Acquisitions/mergers are different from CHOWs. In the case of an acquisition/merger, the seller/former owner's CCN dissolves. In a CHOW, the seller/former owner's CCN typically remains intact and is transferred to the new owner. A consolidation occurs when two or more enrolled Medicare providers consolidate to form a new business entity. Consolidations are different from acquisitions/mergers. In an acquisition/merger, two entities combine but the CCN and tax identification number (TIN) of the purchasing entity remains intact. In a consolidation, the TINs and CCN of the consolidating entities dissolve and a new TIN and CCN are assigned to the new, consolidated entity. Source: Missouri Department of Health and Senior Services, Change of Ownership Guidelines—Medicare/State Certified Hospice. Retrieved August 23, 2023, from https://health.mo.gov/safety/homecare/pdf/CHOW-Guidelines-

StateLicensedHospice.pdf#:~:text=Acquisitions%2Fmergers%20are%20different%20from%20CHOWs.%20In%20the%20case,provider

s%20consolidate%20to%20form%20a%20new%20business%20entity. - The Source on Healthcare Price and Competition, Merger Review, Retrieved August 23, 2023 from https://sourceonhealthcare.org/market-consolidation/merger-review/

Methodology

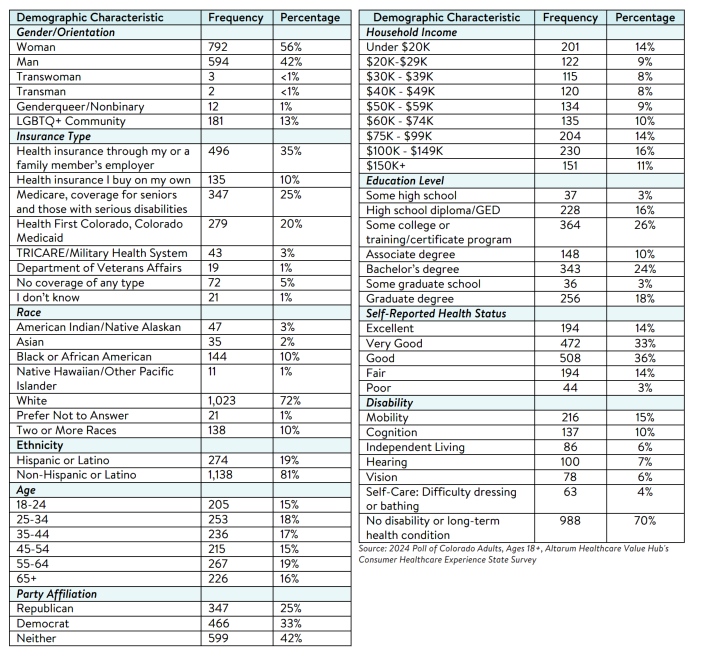

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ views on a wide range of health system issues, including confidence using the health system, financial burden and possible policy solutions. This survey, conducted from March 26 to April 12, 2024, used a web panel from Dynata with a demographically balanced sample of approximately 1,500 respondents who live in Colorado. Information about Dynata’s recruitment and compensation methods can be found here. The survey was conducted in English or Spanish and restricted to adults ages 18 and older. Respondents who

finished the survey in less than half the median time were excluded from the final sample, leaving 1,412 cases for analysis. After those exclusions, the demographic composition of respondents was as follows, although not all demographic information has complete response rates:

unweighted. An explanation of weighted versus unweighted variables is available here. Altarum does not conduct statistical calculations on the significance of differences between groups in findings. Therefore, determinations that one group experienced a significantly different affordability burden than another should not be inferred. Rather, comparisons are for conversational purposes. The groups selected for this brief were selected by advocate partners in each state based on organizational/advocacy priorities. We do not report any estimates under N=100 and a co-efficient of variance more than 0.30.